Question: Question 41 3 pts Consider a long forward contract on 1,000 Euro with a remaining maturity of 6 months. The current spot exchange rate is

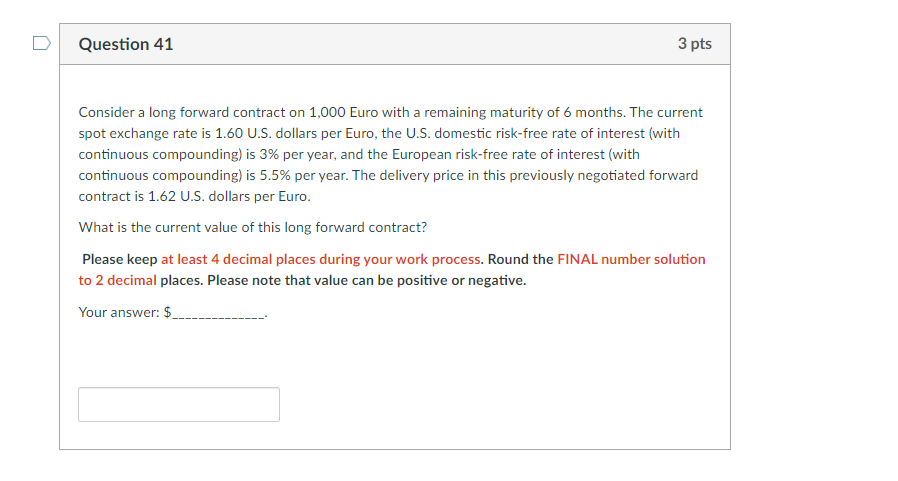

Question 41 3 pts Consider a long forward contract on 1,000 Euro with a remaining maturity of 6 months. The current spot exchange rate is 1.60 U.S. dollars per Euro, the U.S. domestic risk-free rate of interest (with continuous compounding) is 3% per year, and the European risk-free rate of interest (with continuous compounding) is 5.5% per year. The delivery price in this previously negotiated forward contract is 1.62 U.S. dollars per Euro. What is the current value of this long forward contract? Please keep at least 4 decimal places during your work process. Round the FINAL number solution to 2 decimal places. Please note that value can be positive or negative. Your answer: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts