Question: Question 41 3 pts Evaluate the following project using the internal rate of return (IRR) method. If the opportunity cost of capital is 10%, what

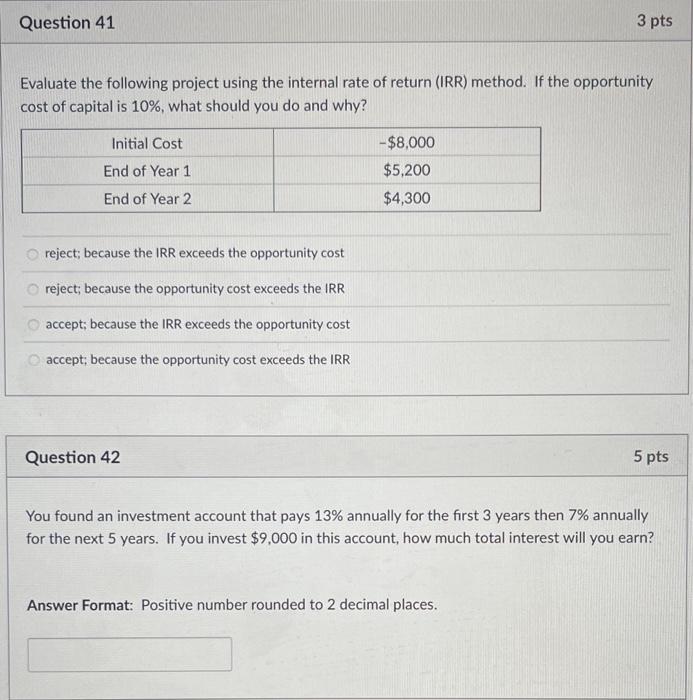

Question 41 3 pts Evaluate the following project using the internal rate of return (IRR) method. If the opportunity cost of capital is 10%, what should you do and why? Initial Cost -$8,000 End of Year 1 $5,200 End of Year 2 $4,300 reject; because the IRR exceeds the opportunity cost reject; because the opportunity cost exceeds the IRR accept; because the IRR exceeds the opportunity cost O accept; because the opportunity cost exceeds the IRR Question 42 5 pts You found an investment account that pays 13% annually for the first 3 years then 7% annually for the next 5 years. If you invest $9,000 in this account, how much total interest will you earn? Answer Format: Positive number rounded to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts