Question: Question 41 Based on the information, what appears to be happening in the single-family home market in this community? Q42 What is your adjustment for

Question 41

Based on the information, what appears to be happening in the single-family home market in this community?

Q42

What is your adjustment for the garage?

Q43

What is your adjustment for the number of bathrooms?

Q44

What is your adjustment for the number of bedrooms?

Q45

What is your adjustment for a hillside lot?

Q46

What is your adjustment for the fireplace?

Q47

What is your estimate of market value for the subject?

Q48

Potential disadvantages of the limited partnership include:

Group of answer choices

losses are treated as passive, as the partner's gross income moves from $100,000 to $125,000.

losses in excess of $25,000 in any one taxable year are treated as passive in nature.

losses for all limited partners, without exception, are treated as passive in nature.

losses are treated as passive in nature, if the partner's gross income exceeds $125,000.

Question 49

The Unified Gift and Inheritance Tax:

Group of answer choices

all of these choices are correct

is based on the market value of the gift or inheritance.

is added to the recipient's adjusted tax basis.

is levied on the recipient of a gift or inheritance.

Q50

In like-kind exchanges:

Group of answer choices

transaction costs may be considered an increase in the purchase price of the acquired property and an increase in the realized gain.

transaction costs may be considered as a reduction in the proceeds from the old property and a reduction in the realized gain.

transaction costs may be considered an increase in the purchase price of the acquired property and a reduction in the realized gain.

transaction costs may be considered as a reduction in the proceeds from the old property or an increase in the purchase price of the acquired property and a reduction in the realized gain.

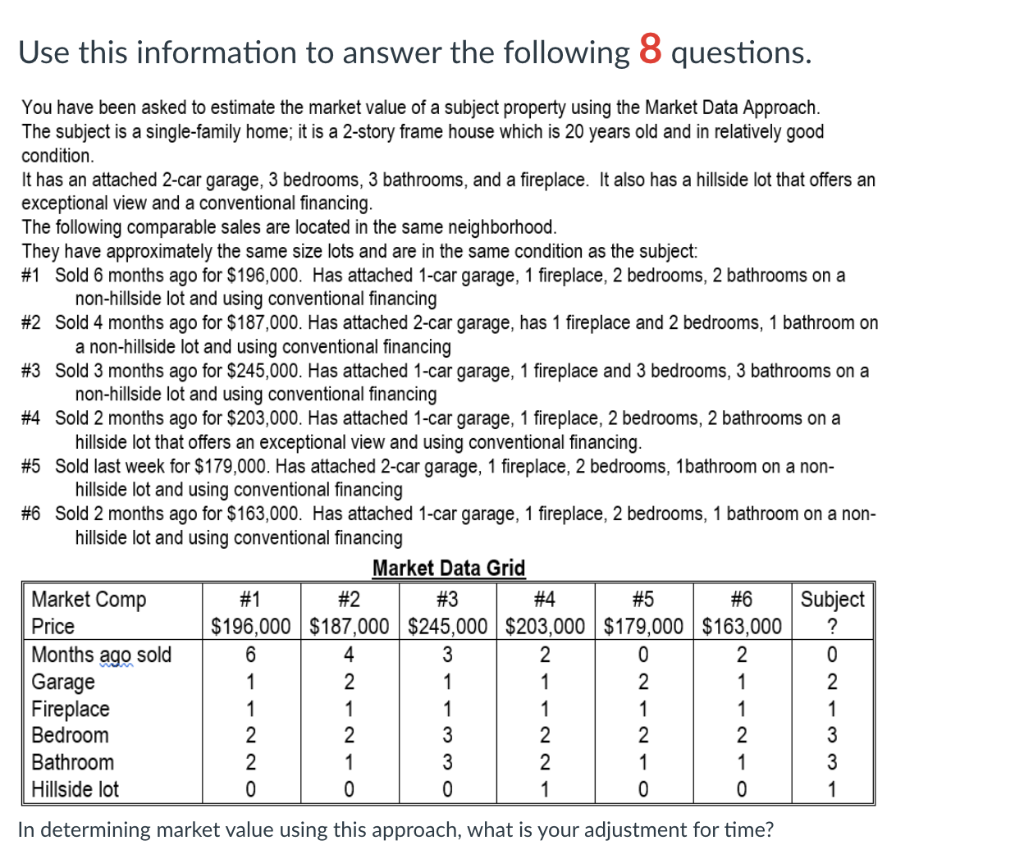

Use this information to answer the following 8 questions. You have been asked to estimate the market value of a subject property using the Market Data Approach. The subject is a single-family home; it is a 2-story frame house which is 20 years old and in relatively good condition. It has an attached 2-car garage, 3 bedrooms, 3 bathrooms, and a fireplace. It also has a hillside lot that offers an exceptional view and a conventional financing. The following comparable sales are located in the same neighborhood. They have approximately the same size lots and are in the same condition as the subject: #1 Sold 6 months ago for $196,000. Has attached 1-car garage, 1 fireplace, 2 bedrooms, 2 bathrooms on a non-hillside lot and using conventional financing #2 Sold 4 months ago for $187,000. Has attached 2-car garage, has 1 fireplace and 2 bedrooms, 1 bathroom on a non-hillside lot and using conventional financing #3 Sold 3 months ago for $245,000. Has attached 1-car garage, 1 fireplace and 3 bedrooms, 3 bathrooms on a non-hillside lot and using conventional financing #4 Sold 2 months ago for $203,000. Has attached 1-car garage, 1 fireplace, 2 bedrooms, 2 bathrooms on a hillside lot that offers an exceptional view and using conventional financing. #5 Sold last week for $179,000. Has attached 2-car garage, 1 fireplace, 2 bedrooms, 1bathroom on a non- hillside lot and using conventional financing #6 Sold 2 months ago for $163,000. Has attached 1-car garage, 1 fireplace, 2 bedrooms, 1 bathroom on a non- hillside lot and using conventional financing Market Data Grid Market Comp #1 #2 #3 #4 #5 #6 Subject Price $196,000 $187,000 $245,000 $203,000 $179,000 $163,000 ? Months ago sold 6 4 3 2 0 2 Garage 1 2 1 1 2 1 Fireplace 1 1 1 1 1 1 1 Bedroom 2 2 3 2 2 2 3 Bathroom 2 1 3 2 1 1 3 Hillside lot 0 0 0 1 0 0 1 NO NN In determining market value using this approach, what is your adjustment for time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts