Question: QUESTION 41 is a long-term debt instrument by which a borrower of funds agrees to pay back the principal with interest on specific dates in

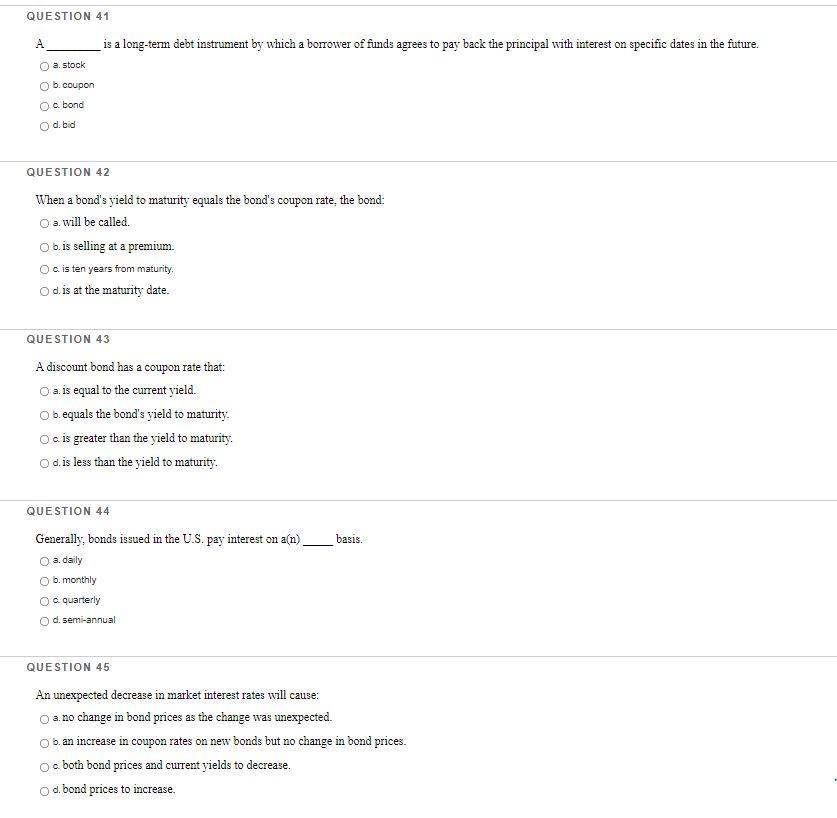

QUESTION 41 is a long-term debt instrument by which a borrower of funds agrees to pay back the principal with interest on specific dates in the future. a stock Ob.coupon O c. bond d. bid QUESTION 42 When a bond's yield to maturity equals the bond's coupon rate, the bond: O a. will be called O b. is selling at a premium Oc is ten years from maturity. O d. is at the maturity date QUESTION 43 A discount bond has a coupon rate that: a. is equal to the current yield. O b.equals the bond's yield to maturity: Oc is greater than the yield to maturity O d. is less than the yield to maturity. QUESTION 44 basis. Generally, bonds issued in the U.S. pay interest on a(n) O a daily b. monthly O quarterly O d. semi-annual QUESTION 45 An unexpected decrease in market interest rates will cause: O a no change in bond prices as the change was unexpected. O b. an increase in coupon rates on new bonds but no change in bond prices. O e both bond prices and current yields to decrease. Odbond prices to increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts