Question: Question 41 Not yet Consider two bonds. Both bonds have a maturity of three years, a face value of 100 EUR, and are repaid at

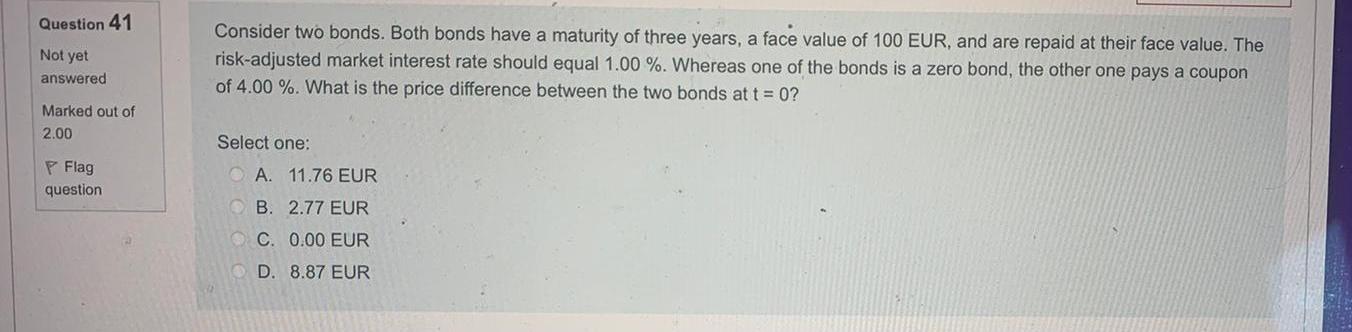

Question 41 Not yet Consider two bonds. Both bonds have a maturity of three years, a face value of 100 EUR, and are repaid at their face value. The risk-adjusted market interest rate should equal 1.00 %. Whereas one of the bonds is a zero bond, the other one pays a coupon of 4.00 %. What is the price difference between the two bonds at t = 0? answered Marked out of 2.00 Select one: P Flag question A. 11.76 EUR B. 2.77 EUR C. 0.00 EUR D. 8.87 EUR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts