Question: Question 41: The answer is not 2 or 2.14. The answer should be a whole number. Question 11: Stock XYZ trades now for $75. You

Question 41:

The answer is not 2 or 2.14. The answer should be a whole number.

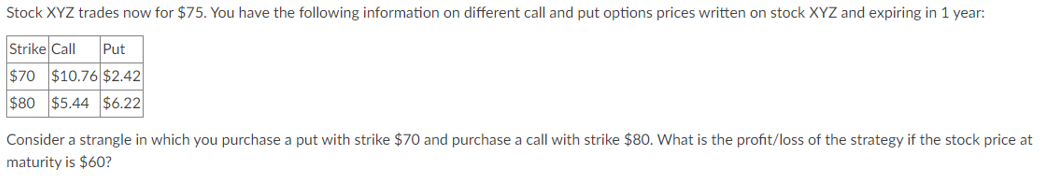

Question 11:

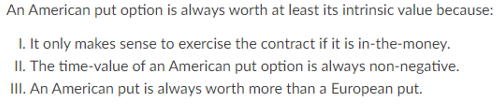

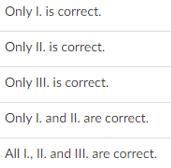

Stock XYZ trades now for $75. You have the following information on different call and put options prices written on stock XYZ and expiring in 1 year: Strike Call Put $70 $10.76 $2.42 $80 $5.44 $6.22 Consider a strangle in which you purchase a put with strike $70 and purchase a call with strike $80. What is the profit/loss of the strategy if the stock price at maturity is $60? An American put option is always worth at least its intrinsic value because: 1. It only makes sense to exercise the contract if it is in-the-money. II. The time-value of an American put option is always non-negative. III. An American put is always worth more than a European put. Only I. is correct. Only II. is correct. Only III. is correct. Only I. and II. are correct. All L. II. and III. are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts