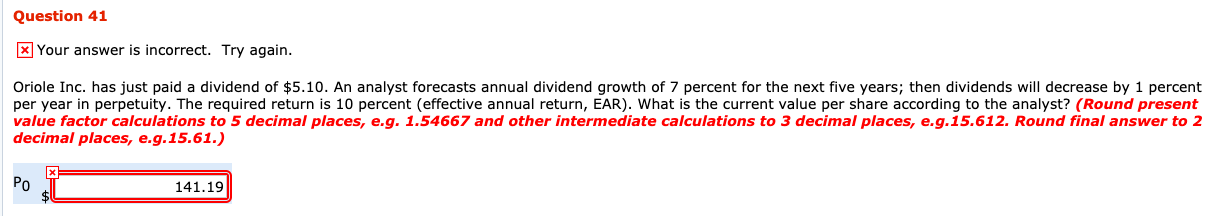

Question: Question 41 x Your answer is incorrect. Try again. Oriole Inc. has just paid a dividend of $5.10. An analyst forecasts annual dividend growth of

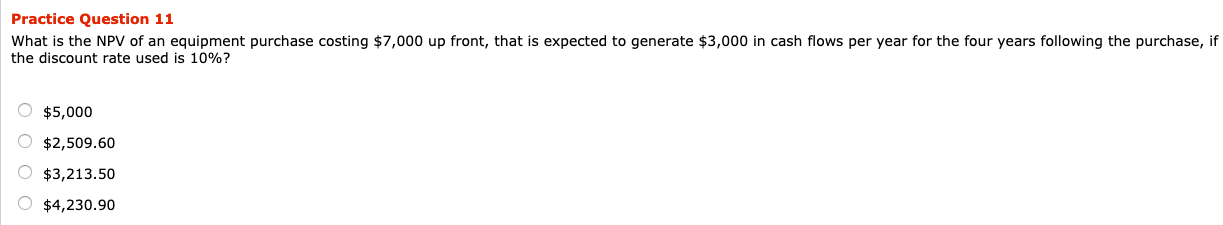

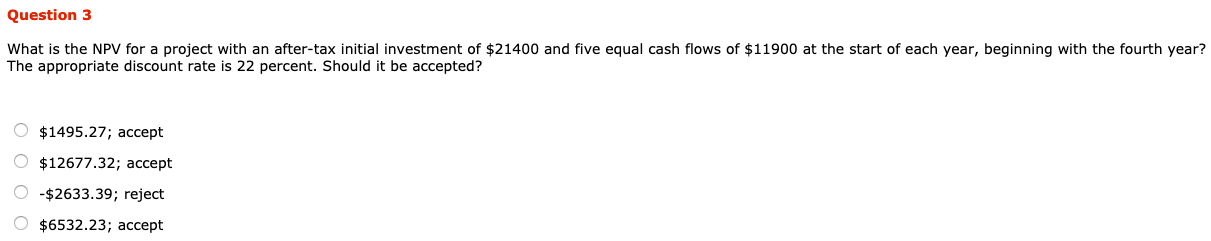

Question 41 x Your answer is incorrect. Try again. Oriole Inc. has just paid a dividend of $5.10. An analyst forecasts annual dividend growth of 7 percent for the next five years; then dividends will decrease by 1 percent per year in perpetuity. The required return is 10 percent (effective annual return, EAR). What is the current value per share according to the analyst? (Round present value factor calculations to 5 decimal places, e.g. 1.54667 and other intermediate calculations to 3 decimal places, e.g. 15.612. Round final answer to 2 decimal places, e.g.15.61.) . 141.19 Practice Question 11 What is the NPV of an equipment purchase costing $7,000 up front, that is expected to generate $3,000 in cash flows per year for the four years following the purchase, if the discount rate used is 10%? $5,000 $2,509.60 $3,213.50 $4,230.90 Question 3 What is the NPV for a project with an after-tax initial investment of $21400 and five equal cash flows of $11900 at the start of each year, beginning with the fourth year? The appropriate discount rate is 22 percent. Should it be accepted? O $1495.27; accept O $12677.32; accept -$2633.39; reject O $6532.23; accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts