Question: Question 42 (1 point) A mutual fund charges 3% front-load fee and has a 1% expense ratio. Assume the NAV of the fund is currently

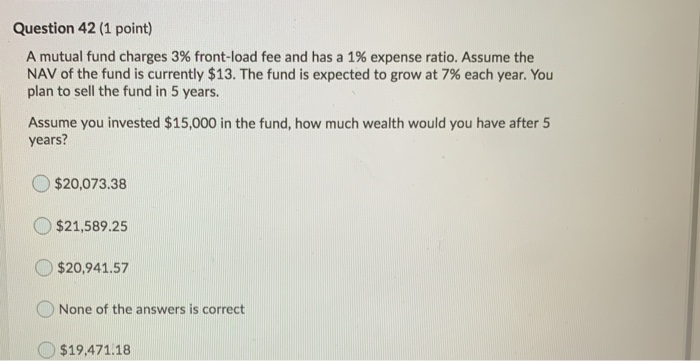

Question 42 (1 point) A mutual fund charges 3% front-load fee and has a 1% expense ratio. Assume the NAV of the fund is currently $13. The fund is expected to grow at 7% each year. You plan to sell the fund in 5 years. Assume you invested $15,000 in the fund, how much wealth would you have after 5 years? $20,073.38 $21,589.25 $20,941.57 None of the answers is correct $19,471.18

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock