Question: Question 43 (1 point) If a cheque that was correctly written (by the Company) and paid by the Bank for $523, but was incorrectly recorded

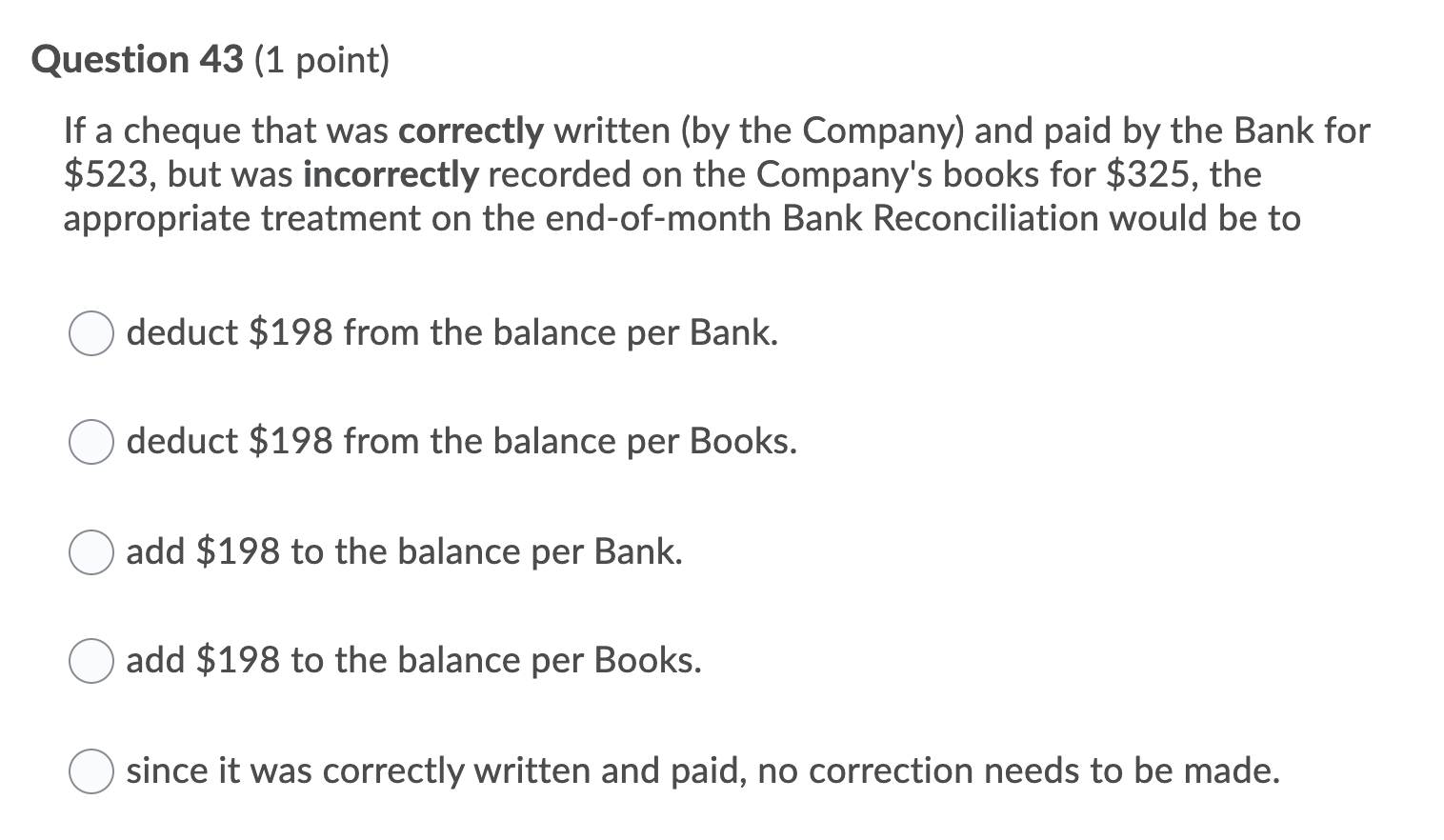

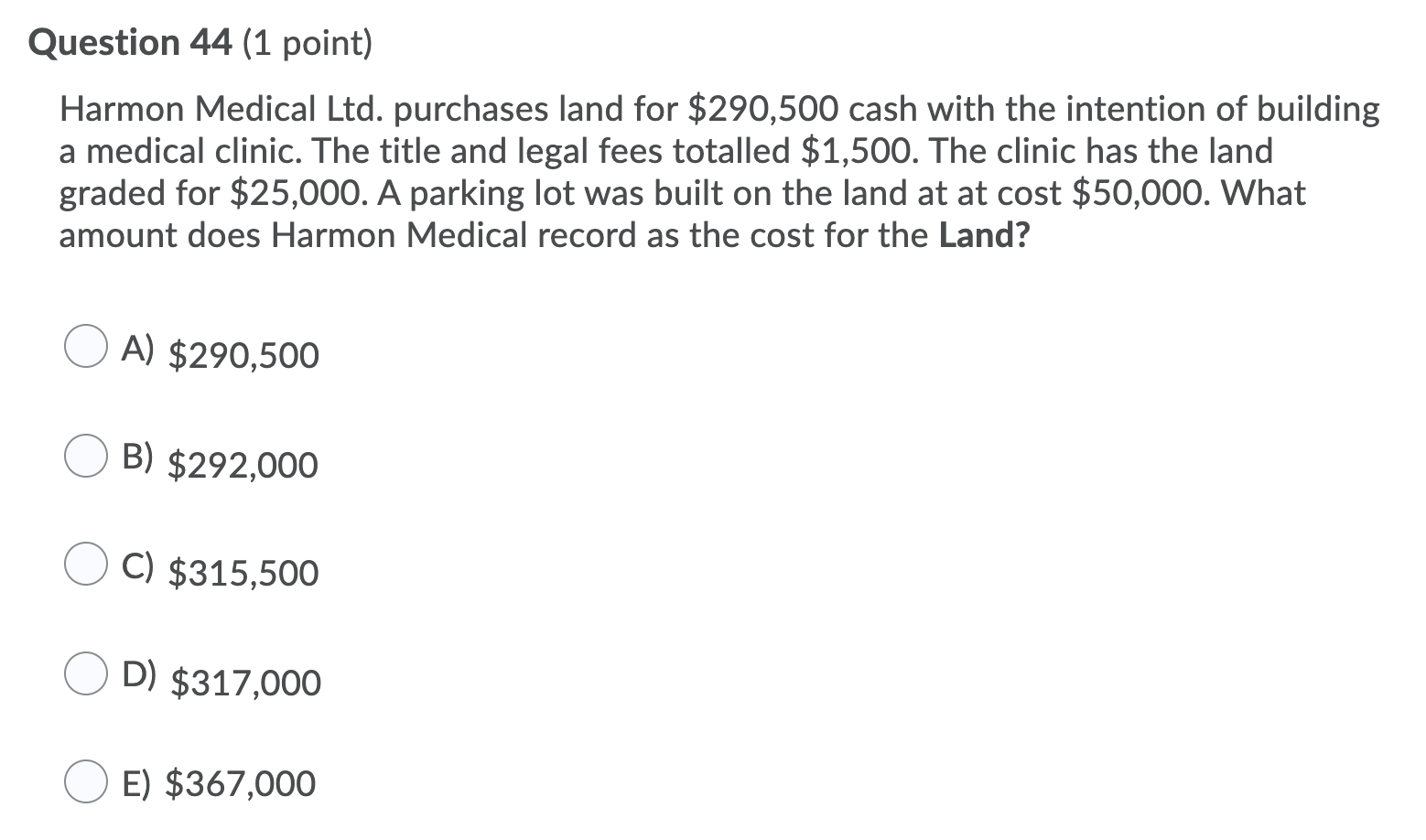

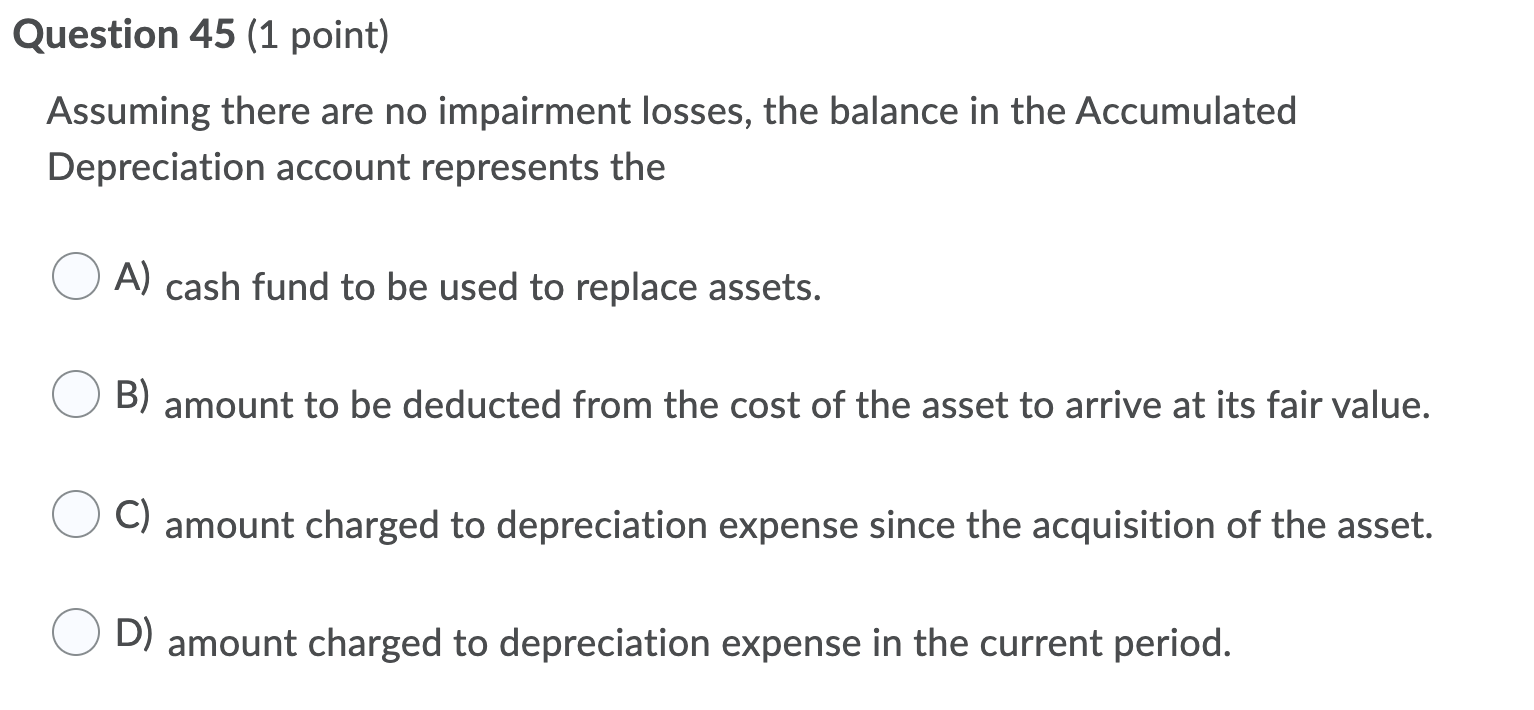

Question 43 (1 point) If a cheque that was correctly written (by the Company) and paid by the Bank for $523, but was incorrectly recorded on the Company's books for $325, the appropriate treatment on the end-of-month Bank Reconciliation would be to deduct $198 from the balance per Bank. deduct $198 from the ba per Books add $198 to the balance per Bank. add $198 to the balance per Books. since it was correctly written and paid, no correction needs to be made. Question 44 (1 point) Harmon Medical Ltd. purchases land for $290,500 cash with the intention of building a medical clinic. The title and legal fees totalled $1,500. The clinic has the land graded for $25,000. A parking lot was built on the land at at cost $50,000. What amount does Harmon Medical record as the cost for the Land? A) $290,500 B) $292,000 C) $315,500 D) $317,000 E) $367,000 Question 45 (1 point) Assuming there are no impairment losses, the balance in the Accumulated Depreciation account represents the A) cash fund to be used to replace assets. B) amount to be deducted from the cost of the asset to arrive at its fair value. C) amount charged to depreciation expense since the acquisition of the asset. D) amount charged to depreciation expense in the current period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts