Question: Question 43 Part B Q1ii 20 points Save A a) A property is currently leased for $100,000 p.a. with fully recoverable outgoings. The lease

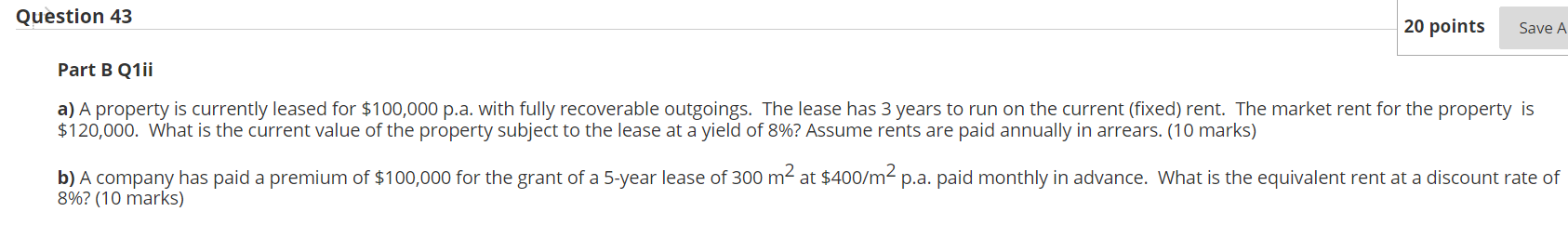

Question 43 Part B Q1ii 20 points Save A a) A property is currently leased for $100,000 p.a. with fully recoverable outgoings. The lease has 3 years to run on the current (fixed) rent. The market rent for the property is $120,000. What is the current value of the property subject to the lease at a yield of 8%? Assume rents are paid annually in arrears. (10 marks) b) A company has paid a premium of $100,000 for the grant of a 5-year lease of 300 m at $400/m p.a. paid monthly in advance. What is the equivalent rent at a discount rate of 8%? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

To answer both parts of the question comprehensively we will follow the stepbystep calculations and necessary financial formulas Part a To find the cu... View full answer

Get step-by-step solutions from verified subject matter experts