Question: Question: (4+3+3) a. Differentiate between spot versus future market with examples and justify how corporate charter and bylaws mitigate conflicts among shareholders? b. Explain the

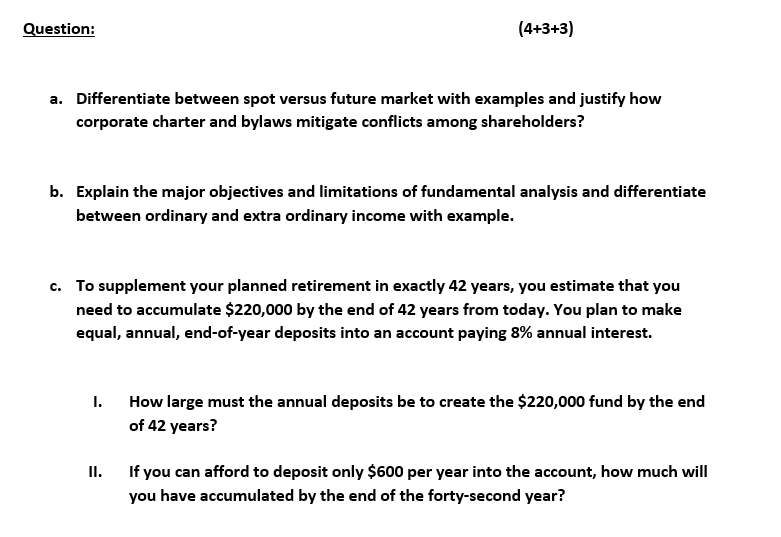

Question: (4+3+3) a. Differentiate between spot versus future market with examples and justify how corporate charter and bylaws mitigate conflicts among shareholders? b. Explain the major objectives and limitations of fundamental analysis and differentiate between ordinary and extra ordinary income with example. c. To supplement your planned retirement in exactly 42 years, you estimate that you need to accumulate $220,000 by the end of 42 years from today. You plan to make equal, annual, end-of-year deposits into an account paying 8% annual interest. 1. How large must the annual deposits be to create the $220,000 fund by the end of 42 years? II. If you can afford to deposit only $600 per year into the account, how much will you have accumulated by the end of the forty-second year? Question: (4+3+3) a. Differentiate between spot versus future market with examples and justify how corporate charter and bylaws mitigate conflicts among shareholders? b. Explain the major objectives and limitations of fundamental analysis and differentiate between ordinary and extra ordinary income with example. c. To supplement your planned retirement in exactly 42 years, you estimate that you need to accumulate $220,000 by the end of 42 years from today. You plan to make equal, annual, end-of-year deposits into an account paying 8% annual interest. 1. How large must the annual deposits be to create the $220,000 fund by the end of 42 years? II. If you can afford to deposit only $600 per year into the account, how much will you have accumulated by the end of the forty-second year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts