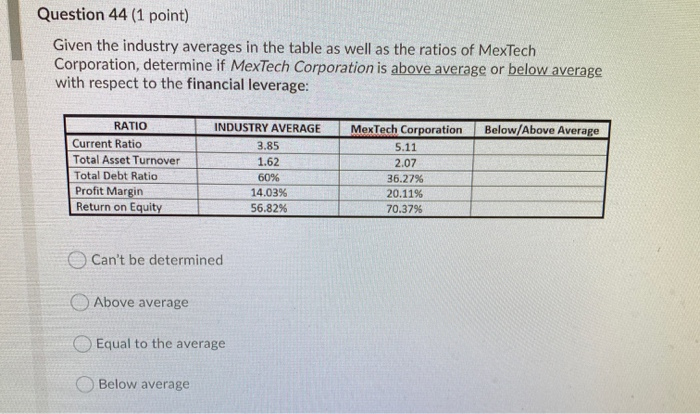

Question: Question 44(1 point) Given the industry averages in the table as well as the ratios of MexTech Corporation, determine if MexTech Corporation is above average

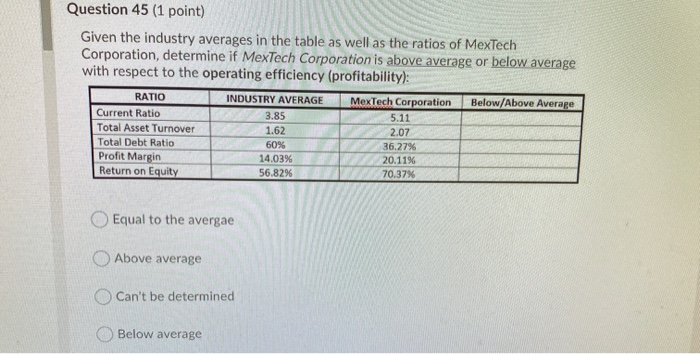

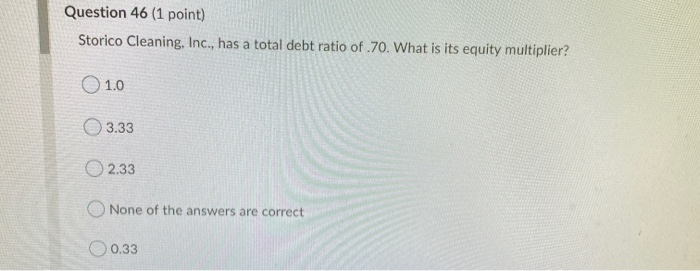

Question 44(1 point) Given the industry averages in the table as well as the ratios of MexTech Corporation, determine if MexTech Corporation is above average or below average with respect to the financial leverage: Below/Above Average RATIO Current Ratio Total Asset Turnover Total Debt Ratio Profit Margin Return on Equity INDUSTRY AVERAGE 3.85 1.62 60% 14.03% 56.82% MexTech Corporation 5.11 2.07 36.27% 20.11% 70.37% Can't be determined Above average Equal to the average Below average Question 45 (1 point) Given the industry averages in the table as well as the ratios of MexTech Corporation, determine if MexTech Corporation is above average or below average with respect to the operating efficiency (profitability): RATIO INDUSTRY AVERAGE MexTech Corporation Below/Above Average Current Ratio 3.85 5.11 Total Asset Turnover 1.62 2.07 Total Debt Ratio 60% 36.27% Profit Margin 14.03% 20.11% Return on Equity 56.82% 70.37% Equal to the avergae Above average Can't be determined Below average Question 46 (1 point) Storico Cleaning, Inc., has a total debt ratio of 70. What is its equity multiplier? 01.0 3.33 2.33 None of the answers are correct 0.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts