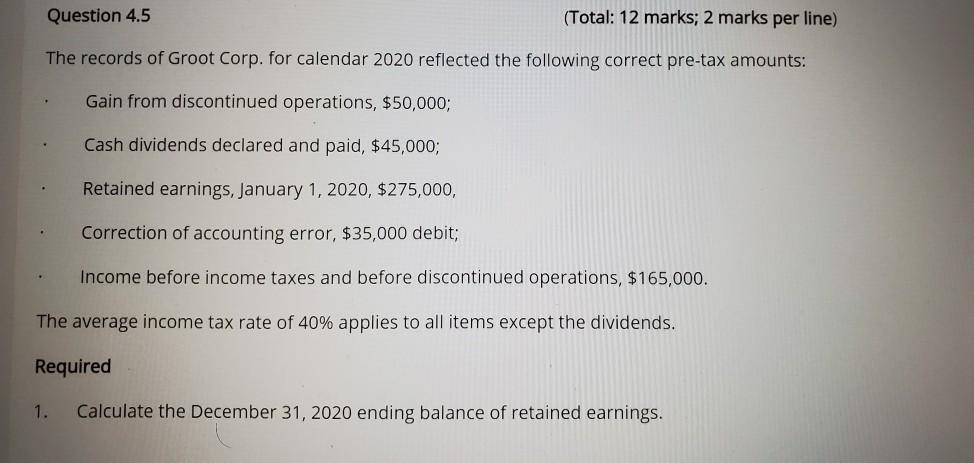

Question: Question 4.5 (Total: 12 marks; 2 marks per line) The records of Groot Corp. for calendar 2020 reflected the following correct pre-tax amounts: Gain from

Question 4.5 (Total: 12 marks; 2 marks per line) The records of Groot Corp. for calendar 2020 reflected the following correct pre-tax amounts: Gain from discontinued operations, $50,000; Cash dividends declared and paid, $45,000; Retained earnings, January 1, 2020, $275,000, Correction of accounting error, $35,000 debit; Income before income taxes and before discontinued operations, $165,000. The average income tax rate of 40% applies to all items except the dividends. Required 1. Calculate the December 31, 2020 ending balance of retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts