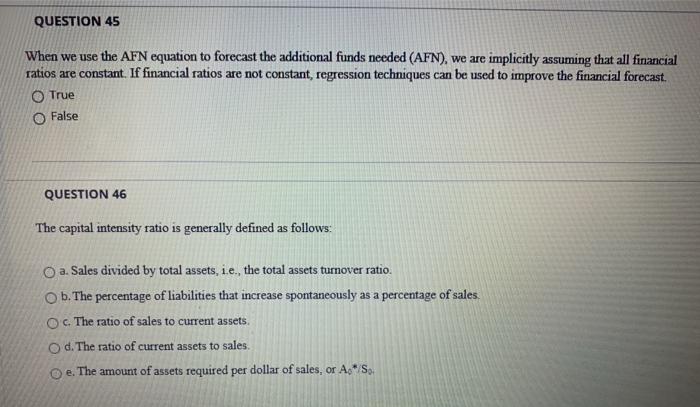

Question: QUESTION 45 When we use the AFN equation to forecast the additional funds needed (AFN), we are implicitly assuming that all financial ratios are constant.

QUESTION 45 When we use the AFN equation to forecast the additional funds needed (AFN), we are implicitly assuming that all financial ratios are constant. If financial ratios are not constant, regression techniques can be used to improve the financial forecast. O True O False QUESTION 46 The capital intensity ratio is generally defined as follows: a. Sales divided by total assets, i.e., the total assets turnover ratio. b. The percentage of liabilities that increase spontaneously as a percentage of sales. Oc. The ratio of sales to current assets. Od. The ratio of current assets to sales. e. The amount of assets required per dollar of sales, or Ap*/S, QUESTION 45 When we use the AFN equation to forecast the additional funds needed (AFN), we are implicitly assuming that all financial ratios are constant. If financial ratios are not constant, regression techniques can be used to improve the financial forecast. O True O False QUESTION 46 The capital intensity ratio is generally defined as follows: a. Sales divided by total assets, i.e., the total assets turnover ratio. b. The percentage of liabilities that increase spontaneously as a percentage of sales. Oc. The ratio of sales to current assets. Od. The ratio of current assets to sales. e. The amount of assets required per dollar of sales, or Ap*/S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts