Question: Question 46 2 pts Purchasing Call Options: A call option on Michigan stock specifies an exercise price of $58. Today the stock's price is $65

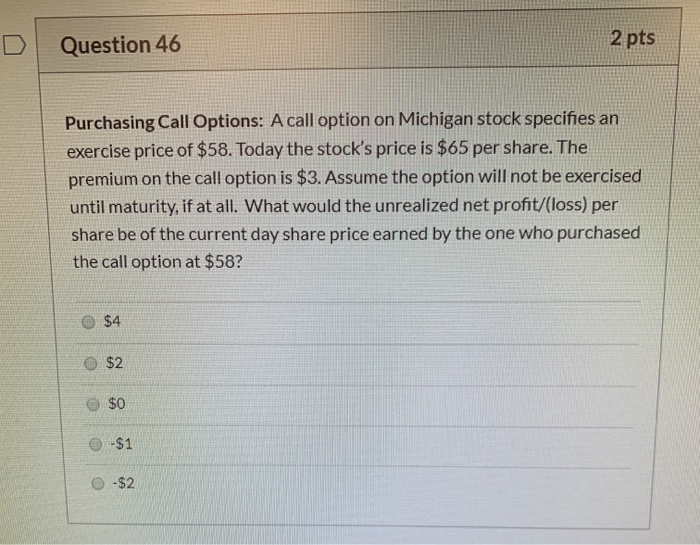

Question 46 2 pts Purchasing Call Options: A call option on Michigan stock specifies an exercise price of $58. Today the stock's price is $65 per share. The premium on the call option is $3. Assume the option will not be exercised until maturity, if at all. What would the unrealized net profit/(loss) per share be of the current day share price earned by the one who purchased the call option at $58? $4 $2 $0 0 0 -$1 0 -$2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts