Question: Question 47 The next 8 questions are based upon the following fact pattern. Answer them individually and round to the nearest dollar. The Dallas Company

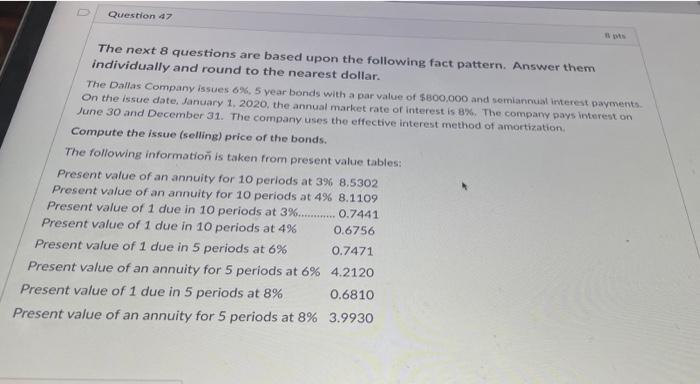

Question 47 The next 8 questions are based upon the following fact pattern. Answer them individually and round to the nearest dollar. The Dallas Company issues 6% 5 year bonds with a par value of $800,000 and semiannual interest payments On the issue date, January 1, 2020, the annual market rate of interest is 8%. The company pays interest on June 30 and December 31. The company uses the effective interest method of amortization Compute the issue (selling) price of the bonds. The following information is taken from present value tables: Present value of an annuity for 10 periods at 3% 8.5302 Present value of an annuity for 10 periods at 4% 8.1109 Present value of 1 due in 10 periods at 3%............0.7441 Present value of 1 due in 10 periods at 4% 0.6756 Present value of 1 due in 5 periods at 6% 0.7471 Present value of an annuity for 5 periods at 6% 4.2120 Present value of 1 due in 5 periods at 8% 0.6810 Present value of an annuity for 5 periods at 8% 3.9930

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts