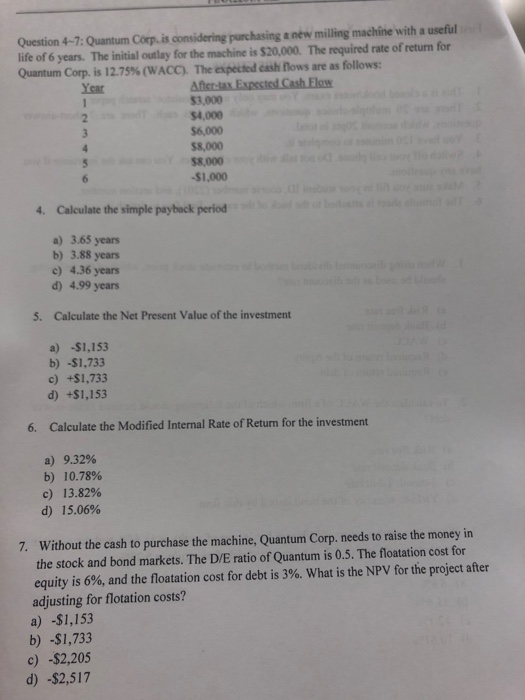

Question: Question 4-7:Quantum Corp is.considering purchasing a new miling machine with a useful life of 6 years. The initial outlay for the machine is $20,000. The

Question 4-7:Quantum Corp is.considering purchasing a new miling machine with a useful life of 6 years. The initial outlay for the machine is $20,000. The required rate of return for Quantum Corp. is 12.75% (W ACC). The espetted cash flows are as follows: Year $3,000 $4,000 $6,000 $8,000 $8,000 -$1,000 2 4. Calculate the simple payback period a) 3.65 years b) 3.88 years c) 4.36 years d) 4.99 years 5. Calculate the Net Present Value of the investment a) -$1,153 b) -$1,733 c) +$1,733 d) +$1,153 6. Calculate the Modified Internal Rate of Return for the investment a) 9.32% b) 10.78% c) 13.82% d) 15.06% Without the cash to purchase the machine, Quantum Corp. needs to raise the money in the stock and bond markets. The D/E ratio of Quantum is 0.5. The floatation cost for equity is 696, and the floatation cost for debt is 3%, what is the NPV for the project after adjusting for flotation costs? a) -$1,153 b) -$1,733 c) -$2,205 7. d) -$2,517

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts