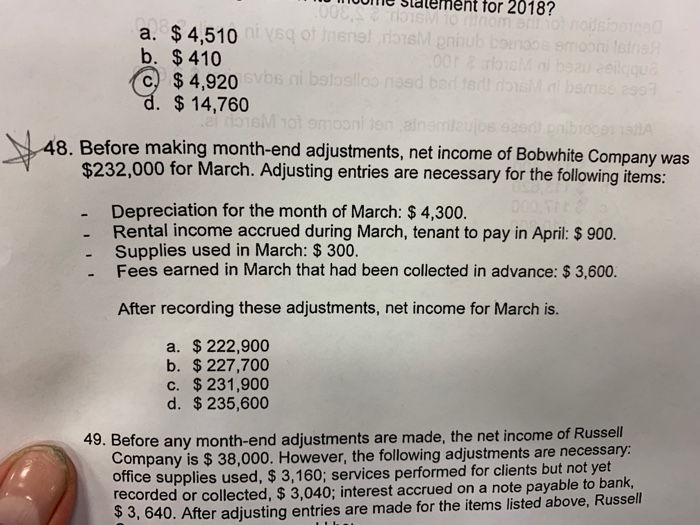

Question: question 48 please tement for 2018? a. $ 4,510 b. 410 C 4,920 01 14,760 48. Before making month-end adjustments, net income of Bobwhite Company

tement for 2018? a. $ 4,510 b. 410 C 4,920 01 14,760 48. Before making month-end adjustments, net income of Bobwhite Company was $232,000 for March. Adjustin g entries are necessary for the following items: Depreciation for the month of March: $4,300. Rental income accrued during March, tenant to pay in April: $ 900. Supplies used in March: $ 300 . Fees earned in March that had been collected in advance: $3,600. After recording these adjustments, net income for March is. a. $222,900 b. $ 227,700 c. 231,900 d. $235,600 49. Before any month-end adjustments are made, the net income of Russell Company is $ 38,000. However, the following adjustments are necessary ice supplies used, $ 3,160; services performed for clients but not yet recorded or collected, $ 3,040; interest accrued on a note payable to bank, 3, 640. After adjusting entries are made for the items listed above, Russell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts