Question: (Question 4-8) You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the revenue and operating

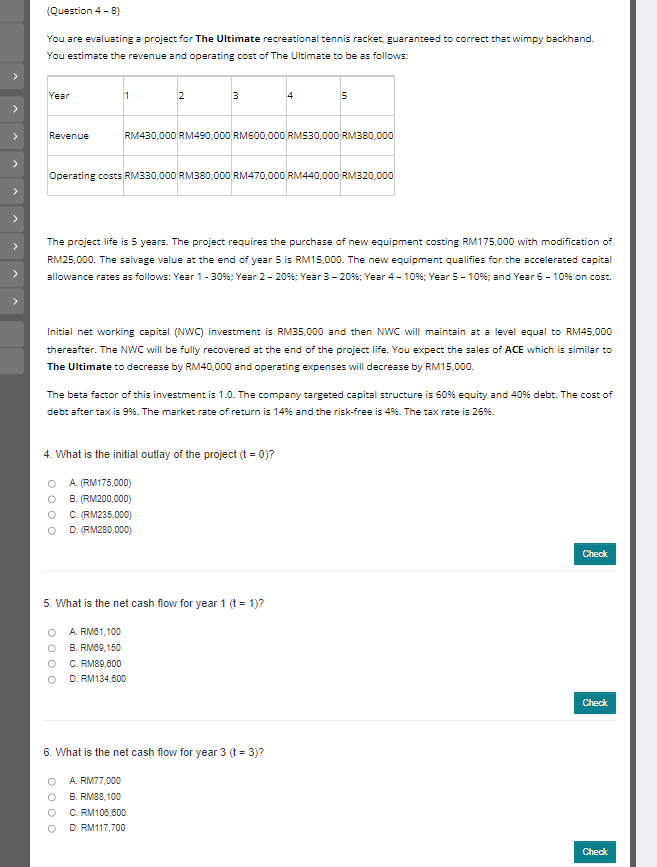

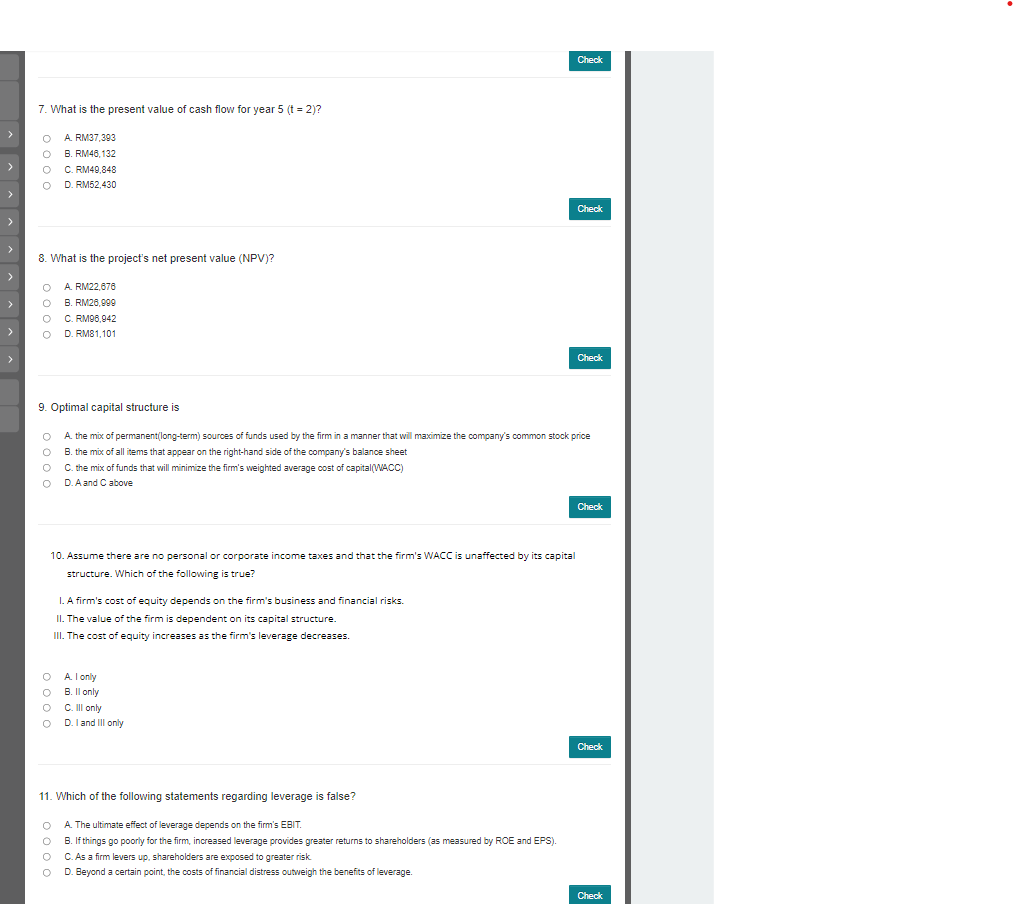

(Question 4-8) You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the revenue and operating cost of The Ultimate to be as follows: The project life is 5 years. The project requires the purchase of new equipment costing RM175,000 with modification of RM25,000. The salvage value at the end of year 5 is RM15,000. The new equipment qualifies for the accelerated capital allowance rates as follows: Year 1 - 30\%; Year 2 - 20\%; Year 3 - 20\%; Year 4 - 10\%; Year 5 - 10\%; and Year 6 - 10% on cost. Initial net working capital (NWC) investment is RM35,000 and then NWC will maintain at a level equal to RM45,000 thereafter. The NWC will be fully recovered at the end of the project life. You expect the sales of ACE which is similar to The Ultimate to decrease by RM40,000 and operating expenses will decrease by RM15,000. The beta factor of this investment is 1.0. The company targeted capital structure is 60% equity and 40% debt. The cost of debt after tax is 9%. The market rate of return is 14% and the risk-free is 4%. The tax rate is 26%. 4. What is the initial outlay of the project (t=0) ? A. (RM175,000) B. (RM200,000) C. (RM235,000) D. (RM280,000) 5. What is the net cash flow for year 1(t=1) ? A. RMB1,100 B. RMB9, 150 C. RM89,800 D. RM134,800 6. What is the net cash flow for year 3(t=3) ? A. RM77,000 B. R MB8,100 C. FM106,800 D. RM117,700 7. What is the present value of cash flow for year 5(t=2) ? A. RI37,393 B. RM46, 132 C. RM49,848 D. RM52,430 8. What is the project's net present value (NPV)? A. RM22,676 B. RM26,999 C. RM96,942 D. RM81,101 9. Optimal capital structure is A. the mix of permanent(long-term) sources of funds used by the firm in a manner that will maximize the company's common stock price B. the mix of all items that appear on the right-hand side of the company's balance sheet C. the mix of funds that will minimize the firm's weighted average cost of capital(MACC) D. A and C above 10. Assume there are no personal or corporate income taxes and that the firm's WACC is unaffected by its capital structure. Which of the following is true? I. A firm's cost of equity depends on the firm's business and financial risks. II. The value of the firm is dependent on its capital structure. III. The cost of equity increases as the firm's leverage decreases. A. I only B. Il only C. III only D. I and III only 11. Which of the following statements regarding leverage is false? A. The ultimate effect of leverage depends on the firm's EBIT. B. If things go poorly for the firm, increased leverage provides greater returns to shareholders (as measured by ROE and EPS). C. As a firm levers up, shareholders are exposed to greater risk D. Beyond a certain point, the costs of financial distress outweigh the benefits of leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts