Question: QUESTION 49 2 points Save Answer Fernando is the sole proprietor of Fernando's Fabulous Florist. The taxes on any profits earned by Fernando's Fabulous Florist

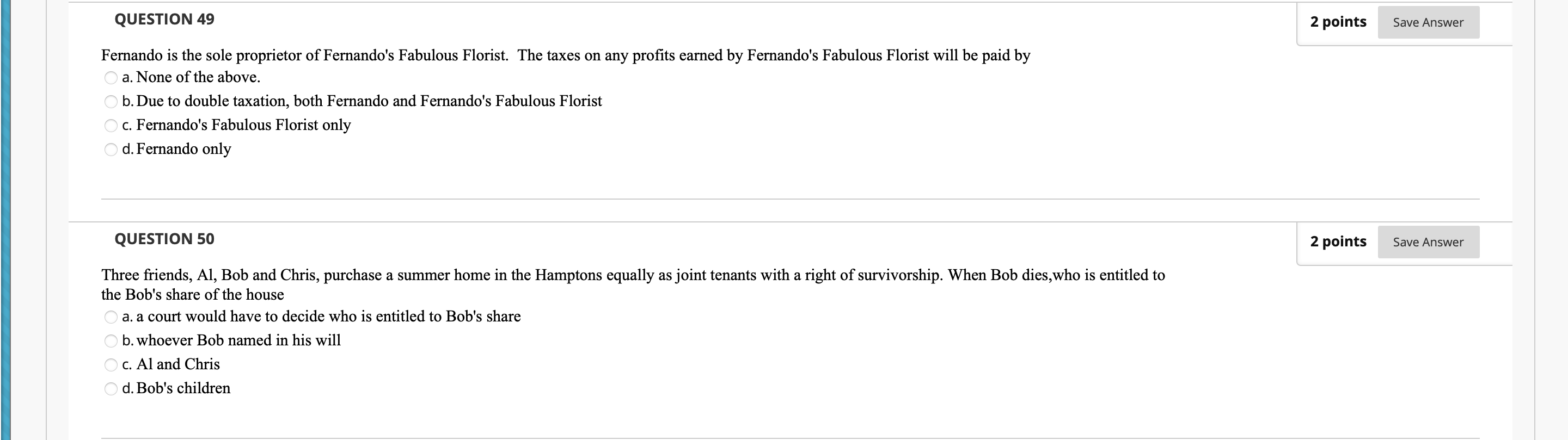

QUESTION 49 2 points Save Answer Fernando is the sole proprietor of Fernando's Fabulous Florist. The taxes on any profits earned by Fernando's Fabulous Florist will be paid by a. None of the above. b. Due to double taxation, both Fernando and Fernando's Fabulous Florist c. Fernando's Fabulous Florist only d. Fernando only QUESTION 50 2 points Save Answer Three friends, Al, Bob and Chris, purchase a summer home in the Hamptons equally as joint tenants with a right of survivorship. When Bob dies,who is entitled to the Bob's share of the house a. a court would have to decide who is entitled to Bob's share b.whoever Bob named in his will c. Al and Chris d. Bob's children

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts