Question: Question 4(9 marks): A 100 unit apartment building is for sale. It rents for 500/unit per month. Operating expenses for the building are 200,000 per

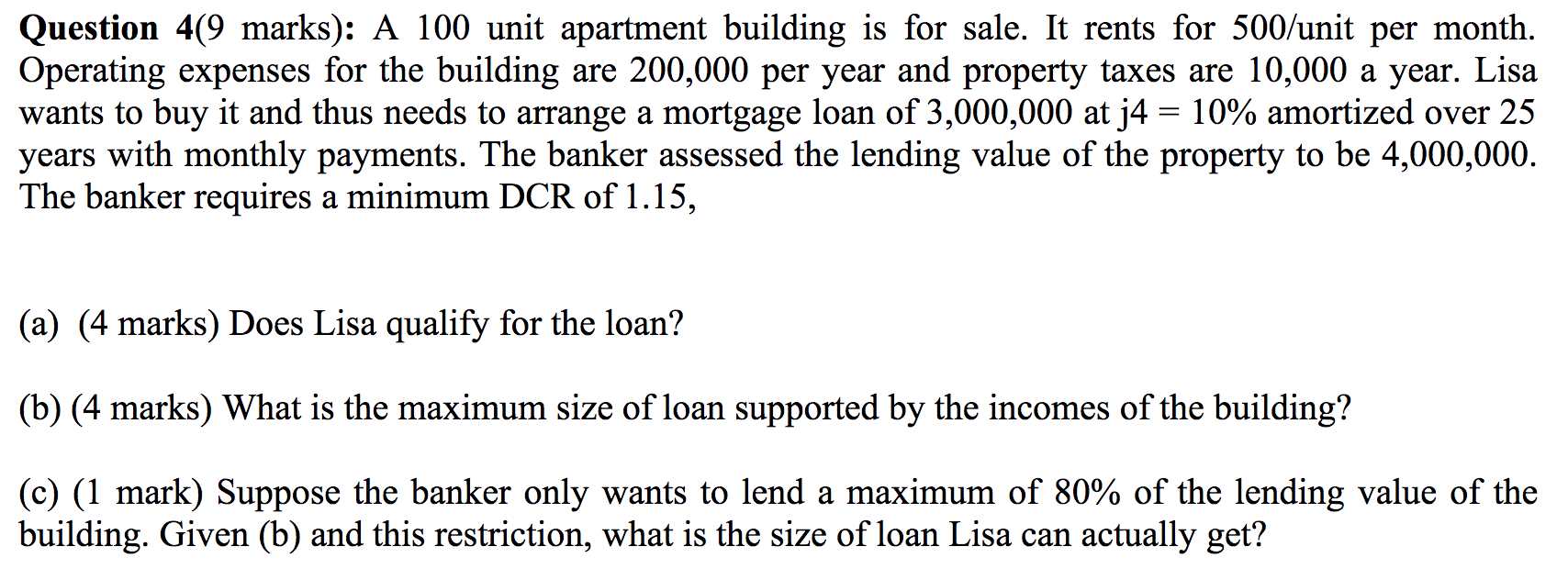

Question 4(9 marks): A 100 unit apartment building is for sale. It rents for 500/unit per month. Operating expenses for the building are 200,000 per year and property taxes are 10,000 a year. Lisa wants to buy it and thus needs to arrange a mortgage loan of 3,000,000 at j4 = 10% amortized over 25 years with monthly payments. The banker assessed the lending value of the property to be 4,000,000. The banker requires a minimum DCR of 1.15, (a) (4 marks) Does Lisa qualify for the loan? (b) (4 marks) What is the maximum size of loan supported by the incomes of the building? (c) (1 mark) Suppose the banker only wants to lend a maximum of 80% of the lending value of the building. Given (b) and this restriction, what is the size of loan Lisa can actually get? Question 4(9 marks): A 100 unit apartment building is for sale. It rents for 500/unit per month. Operating expenses for the building are 200,000 per year and property taxes are 10,000 a year. Lisa wants to buy it and thus needs to arrange a mortgage loan of 3,000,000 at j4 = 10% amortized over 25 years with monthly payments. The banker assessed the lending value of the property to be 4,000,000. The banker requires a minimum DCR of 1.15, (a) (4 marks) Does Lisa qualify for the loan? (b) (4 marks) What is the maximum size of loan supported by the incomes of the building? (c) (1 mark) Suppose the banker only wants to lend a maximum of 80% of the lending value of the building. Given (b) and this restriction, what is the size of loan Lisa can actually get

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts