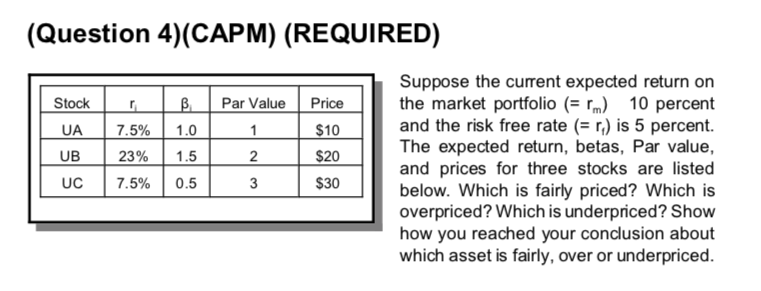

Question: (Question 4)(CAPM) (REQUIRED) Stock UA UB 7.5% 23% 7.5% B. Par Value 1. 0 1 1.5 1 2 0.5 Price $10 $20 $30 Suppose the

(Question 4)(CAPM) (REQUIRED) Stock UA UB 7.5% 23% 7.5% B. Par Value 1. 0 1 1.5 1 2 0.5 Price $10 $20 $30 Suppose the current expected return on the market portfolio (= .) 10 percent and the risk free rate (= r.) is 5 percent. The expected return, betas, Par value, and prices for three stocks are listed below. Which is fairly priced? Which is overpriced? Which is underpriced? Show how you reached your conclusion about which asset is fairly, over or underpriced. UC

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock