Question: Question 4I'm confused by this iz 4 Saved Help Save & Exit 4 On June 1, 2020, the Crocus Company began construction of a new

Question 4I'm confused by this

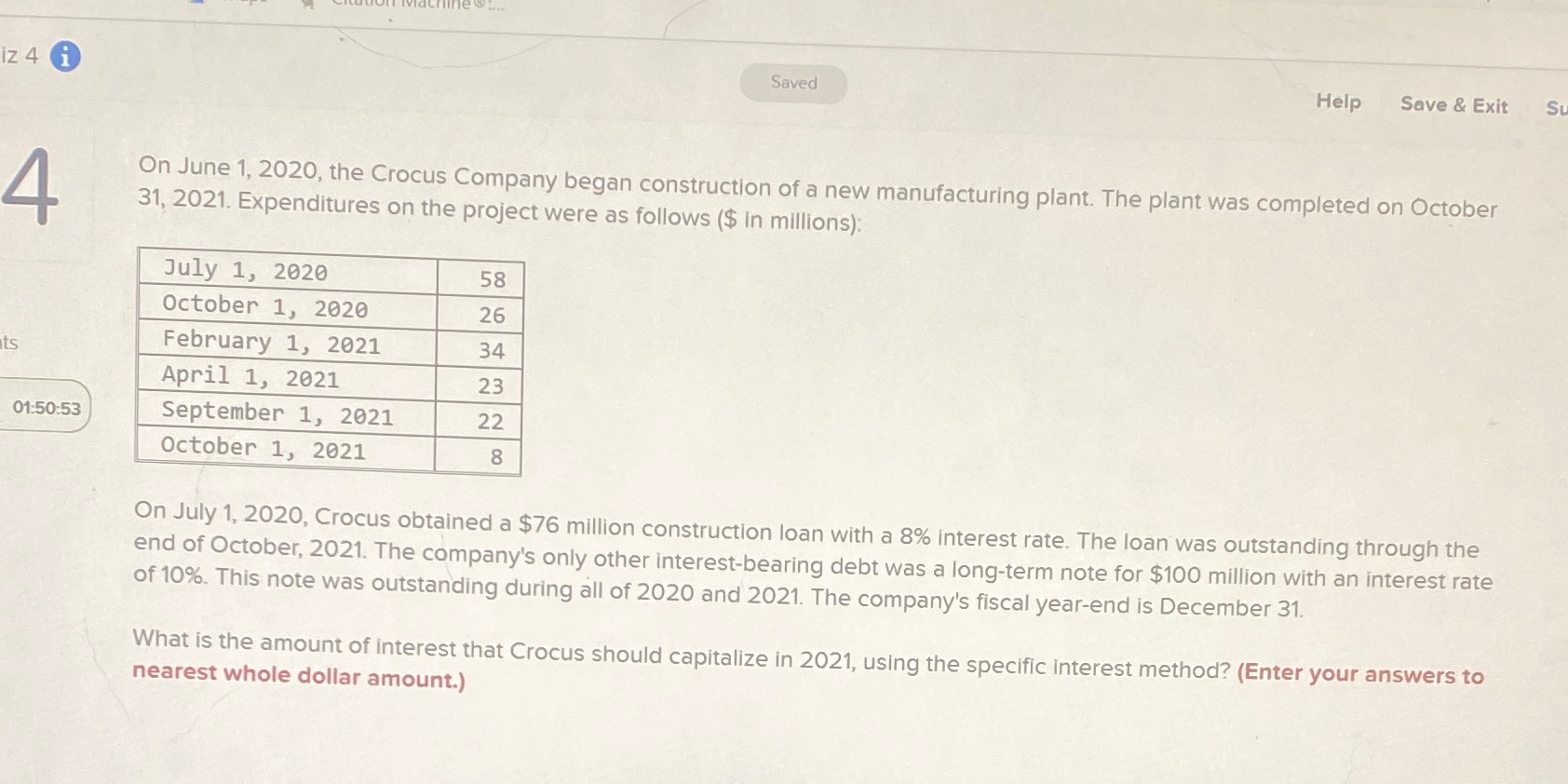

iz 4 Saved Help Save & Exit 4 On June 1, 2020, the Crocus Company began construction of a new manufacturing plant. The plant was completed on October 31, 2021. Expenditures on the project were as follows ($ In millions): July 1, 2020 58 October 1, 2020 26 its February 1, 2021 34 April 1, 2021 23 01:50:53 September 1, 2021 22 October 1, 2021 8 On July 1, 2020, Crocus obtained a $76 million construction loan with a 8% interest rate. The loan was outstanding through the end of October, 2021. The company's only other interest-bearing debt was a long-term note for $100 million with an interest rate of 10%. This note was outstanding during all of 2020 and 2021. The company's fiscal year-end is December 31. What is the amount of interest that Crocus should capitalize in 2021, using the specific interest method? (Enter your answers to nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts