Question: Question 5 0 / 1 point I am financing a $1 million dollar project with equal amounts of equity and non-recourse debt (i.e., project finance).

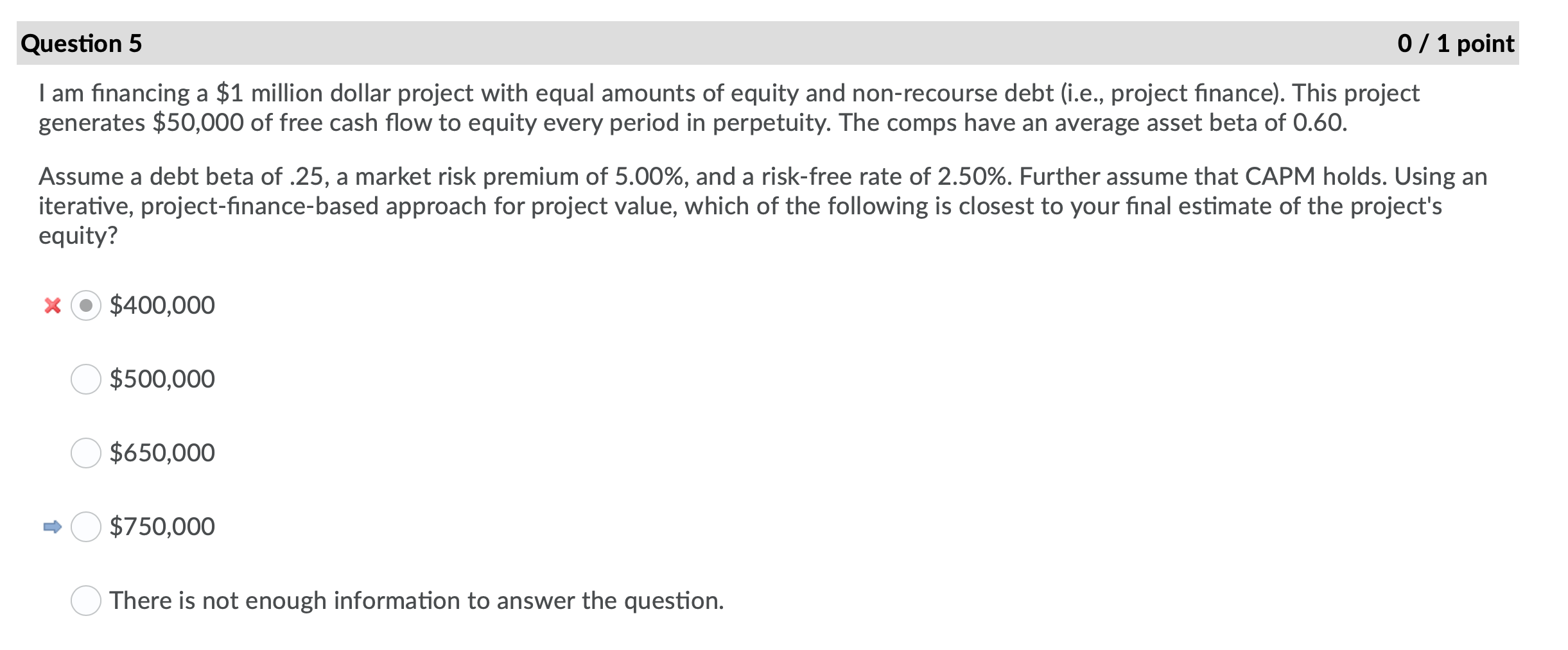

Question 5 0 / 1 point I am financing a $1 million dollar project with equal amounts of equity and non-recourse debt (i.e., project finance). This project generates $50,000 of free cash flow to equity every period in perpetuity. The comps have an average asset beta of 0.60. Assume a debt beta of .25, a market risk premium of 5.00%, and a risk-free rate of 2.50%. Further assume that CAPM holds. Using an iterative, project-finance-based approach for project value, which of the following is closest to your final estimate of the project's equity? X $400,000 $500,000 $650,000 $750,000 There is not enough information to answer the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts