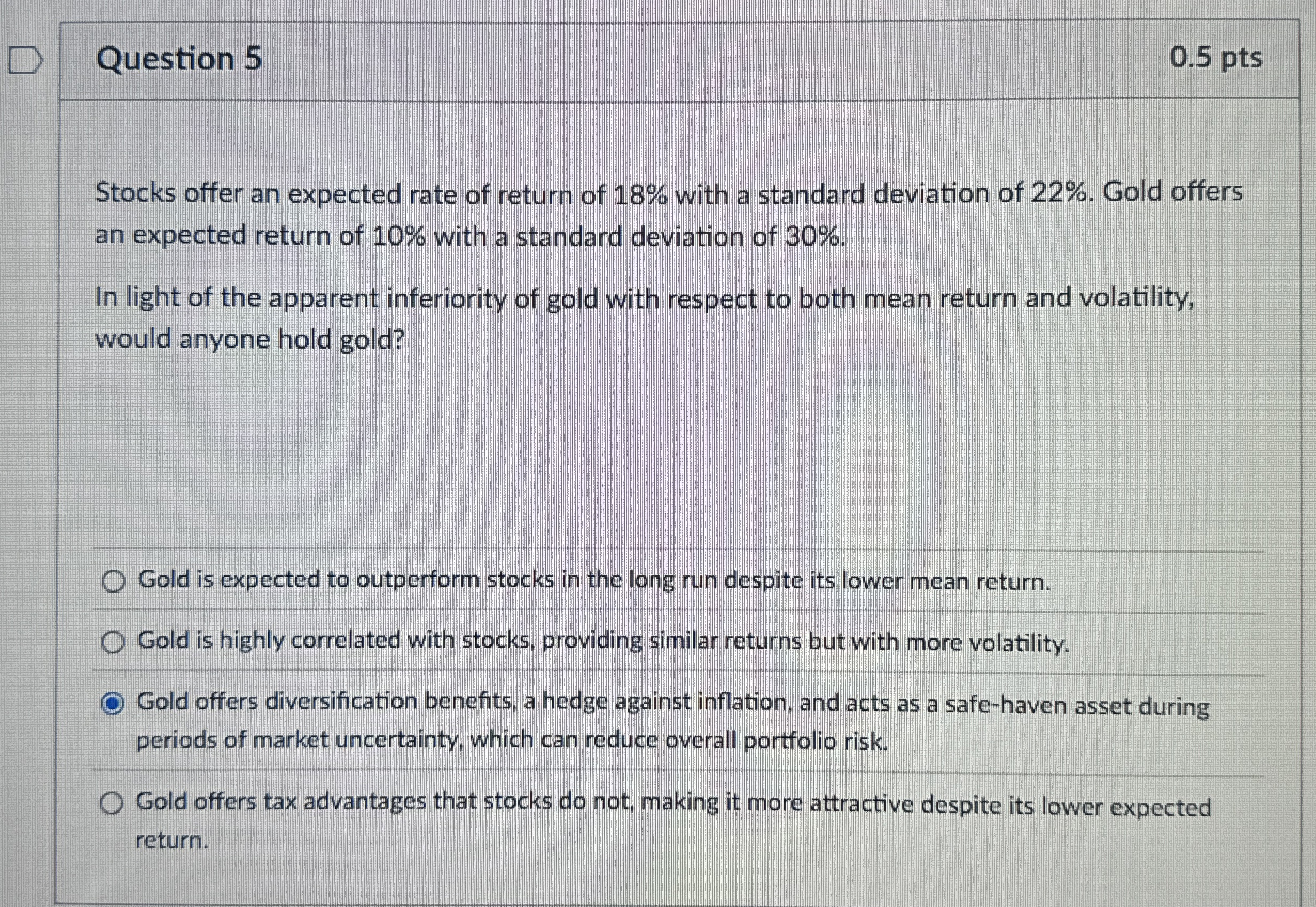

Question: Question 5 0 . 5 pts Stocks offer an expected rate of return of 1 8 % with a standard deviation of 2 2 %

Question

pts

Stocks offer an expected rate of return of with a standard deviation of Gold offers an expected return of with a standard deviation of

In light of the apparent inferiority of gold with respect to both mean return and volatility, would anyone hold gold?

Gold is expected to outperform stocks in the long run despite its lower mean return.

Gold is highly correlated with stocks, providing similar returns but with more volatility.

Gold offers diversification benefits, a hedge against inflation, and acts as a safehaven asset during periods of market uncertainty, which can reduce overall portfolio risk.

Gold offers tax advantages that stocks do not, making it more attractive despite its lower expected return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock