Question: Question 5 0.3 pts Please refer to the Future Value chart on Module Week 2- Future Value and Compound Interest. John is 35 years old,

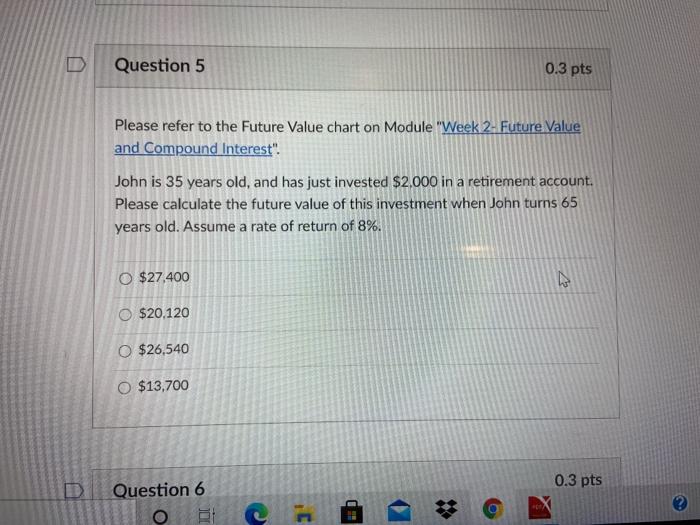

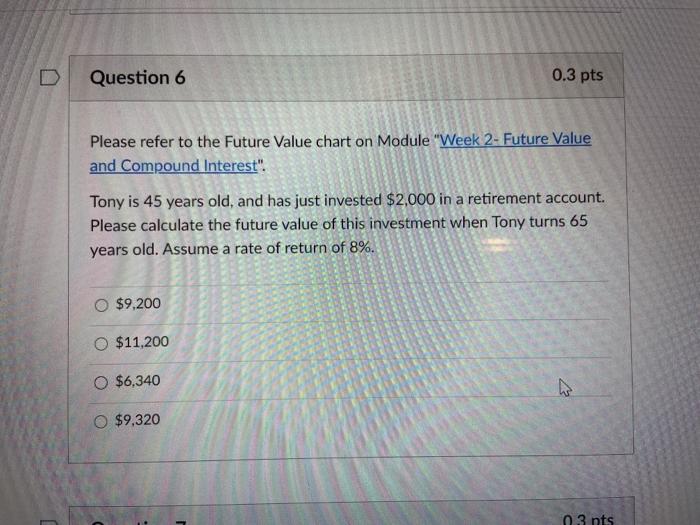

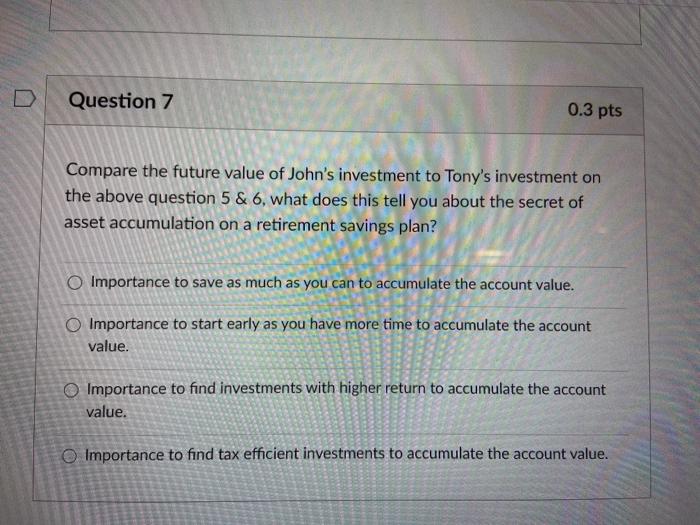

Question 5 0.3 pts Please refer to the Future Value chart on Module "Week 2- Future Value and Compound Interest". John is 35 years old, and has just invested $2,000 in a retirement account. Please calculate the future value of this investment when John turns 65 years old. Assume a rate of return of 8%. O $27,400 O $20,120 $26,540 O $13,700 0.3 pts Question 6 Question 6 0.3 pts Please refer to the Future Value chart on Module "Week 2- Future Value and Compound Interest". Tony is 45 years old, and has just invested $2,000 in a retirement account. Please calculate the future value of this investment when Tony turns 65 years old. Assume a rate of return of 8%. O $9,200 $11,200 O $6,340 w $9,320 0.3 pts Question 7 0.3 pts Compare the future value of John's investment to Tony's investment on the above question 5 & 6, what does this tell you about the secret of asset accumulation on a retirement savings plan? o Importance to save as much as you can to accumulate the account value. Importance to start early as you have more time to accumulate the account value. o Importance to find investments with higher return to accumulate the account value. Importance to find tax efficient investments to accumulate the account value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts