Question: ` ` ` Question 5 ( 1 0 marks ) : ` ` ` The Goferbroke Company develops oil wells in unproven territory. A consulting

Question marks:

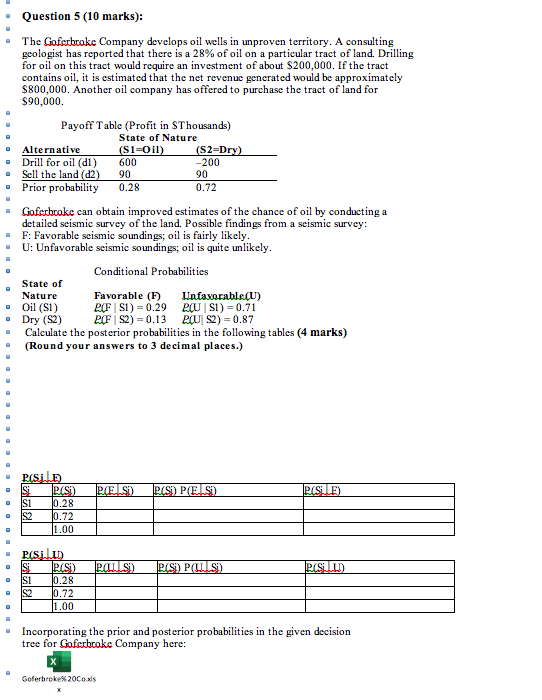

The Goferbroke Company develops oil wells in unproven territory. A consulting geologist has reported that there is a of oil on a particular tract of land. Drilling for oil on this tract would require an investment of about $ If the tract contains oil, it is estimated that the net revenue generated would be approximately $ Another oil company has offered to purchase the tract of land for $

Goferbroke can obtain improved estimates of the chance of oil by conducting a detailed seismic survey of the land. Possible findings from a seismic survey:

F: Favorable scismic soundings; oil is fairly likely.

U : Unfavorable seismic soundings; oil is quite unlikely.

Conditional Probabilities

State of

Nature

Favorable F LnfavorableU

Oil S

Rmathrm~Fmid mathrmS

PmathcalUmid mathrmS

Dry S

Rmathrm~Fmid mathrmS

RmathrmUmid mathrmS

Calculate the posterior probabilities in the following tables marks

Round your answers to decimal places.

BSjLb

PSidu

Incorporating the prior and posterior probabilities in the given decision tree for Goferbrake Company here:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock