Question

pts

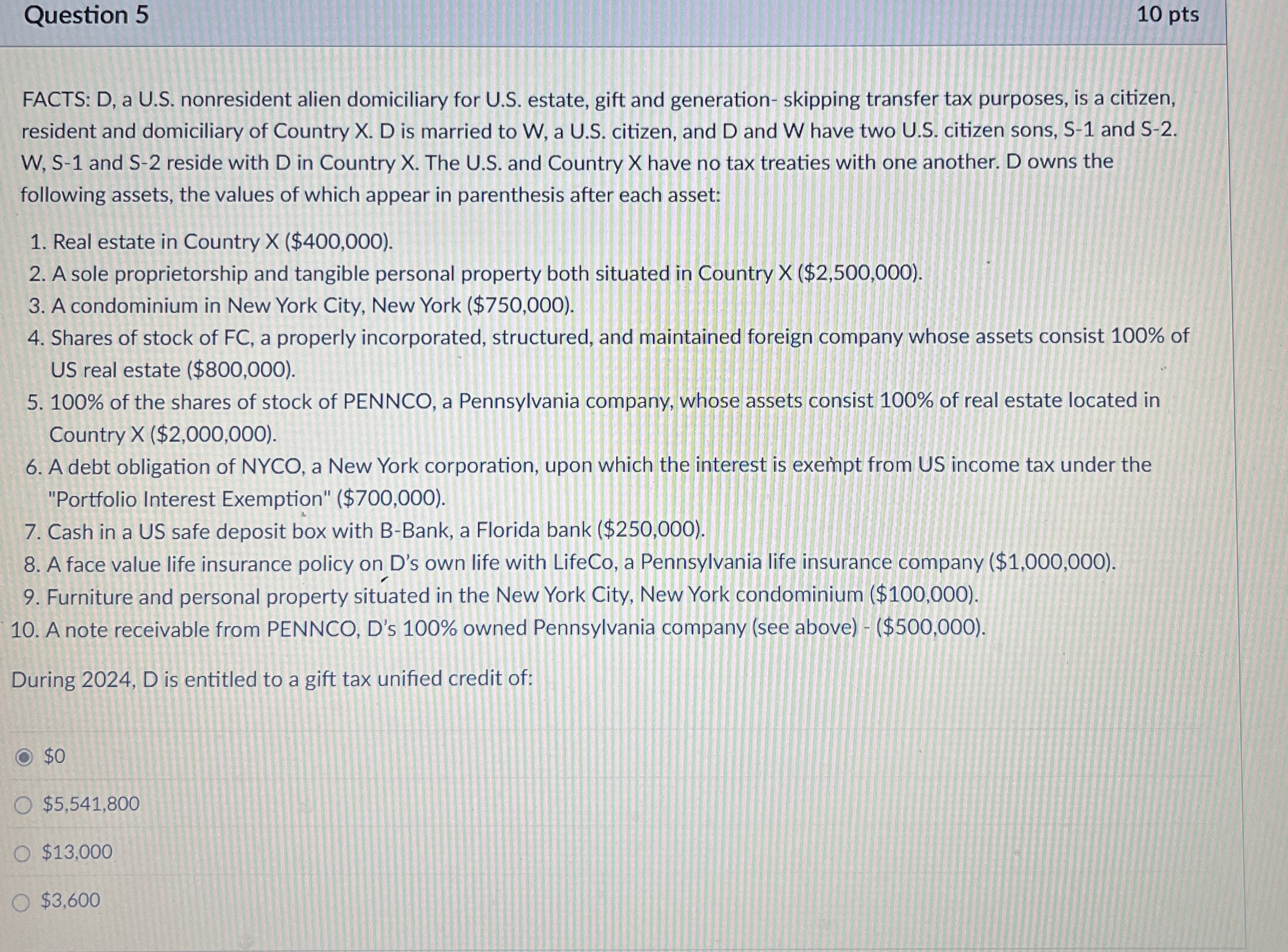

FACTS: D a US nonresident alien domiciliary for US estate, gift and generation skipping transfer tax purposes, is a citizen, resident and domiciliary of Country X D is married to W a US citizen, and D and W have two US citizen sons, S and S W S and S reside with D in Country X The US and Country X have no tax treaties with one another. D owns the following assets, the values of which appear in parenthesis after each asset:

Real estate in Country $

A sole proprietorship and tangible personal property both situated in Country $

A condominium in New York City, New York $

Shares of stock of FC a properly incorporated, structured, and maintained foreign company whose assets consist of US real estate $

of the shares of stock of PENNCO, a Pennsylvania company, whose assets consist of real estate located in Country X $

A debt obligation of NYCO, a New York corporation, upon which the interest is exempt from US income tax under the "Portfolio Interest Exemption" $

Cash in a US safe deposit box with BBank, a Florida bank $

A face value life insurance policy on Ds own life with LifeCo, a Pennsylvania life insurance company $

Furniture and personal property situated in the New York City, New York condominium $

A note receivable from PENNCO, Ds owned Pennsylvania company see above$

During D is entitled to a gift tax unified credit of:

$

$

$

$