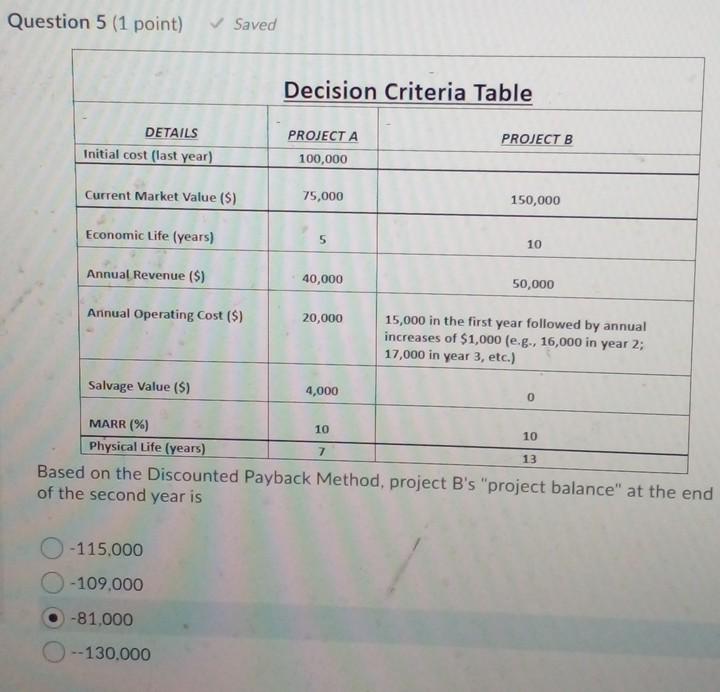

Question: Question 5 (1 point) Saved Decision Criteria Table DETAILS Initial cost (last year) PROJECT B PROJECT A 100,000 Current Market Value (S) 75,000 150,000 Economic

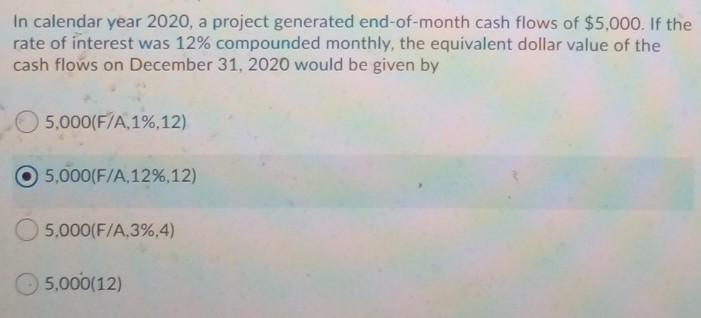

Question 5 (1 point) Saved Decision Criteria Table DETAILS Initial cost (last year) PROJECT B PROJECT A 100,000 Current Market Value (S) 75,000 150,000 Economic Life (years) 5 10 Annual Revenue ($) 40,000 50,000 Annual Operating Cost (%) 20,000 15,000 in the first year followed by annual increases of $1,000 (e.g., 16,000 in year 2; 17,000 in year 3, etc.) Salvage Value (S) 4,000 0 10 10 MARR (%) Physical Life (years) 7 13 Based on the Discounted Payback Method, project B's "project balance" at the end of the second year is -115.000 -109,000 -81.000 --130.000 In calendar year 2020, a project generated end-of-month cash flows of $5,000. If the rate of interest was 12% compounded monthly, the equivalent dollar value of the cash flows on December 31, 2020 would be given by 5,000(F/A,1%.12) 5,000(F/A, 12%,12) 5,000(F/A,3%,4) 5,000(12)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts