Question: Question 5 ( 1 point ) Saved Palmer Co . had a deferred tax liability balance due to a temporary difference at the beginning of

Question point

Saved

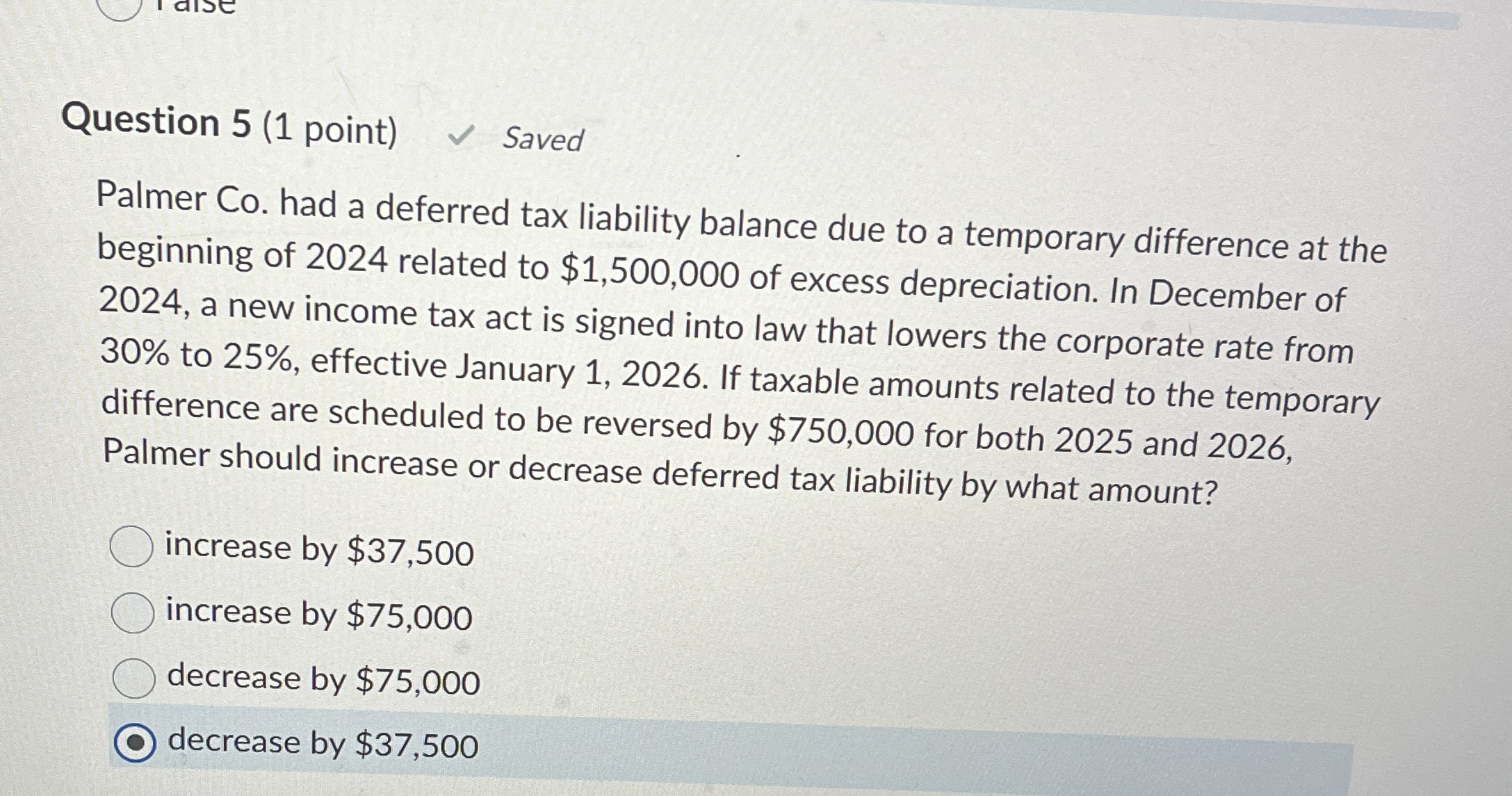

Palmer Co had a deferred tax liability balance due to a temporary difference at the beginning of related to $ of excess depreciation. In December of a new income tax act is signed into law that lowers the corporate rate from to effective January If taxable amounts related to the temporary difference are scheduled to be reversed by $ for both and Palmer should increase or decrease deferred tax liability by what amount?

increase by $

increase by $

decrease by $

decrease by $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock