Question: Question 5 (1 point) Tom, Dick and Harry each own 1/3 of the shares of Food Planet Inc. (a restaurant specializing in organic foods). Food

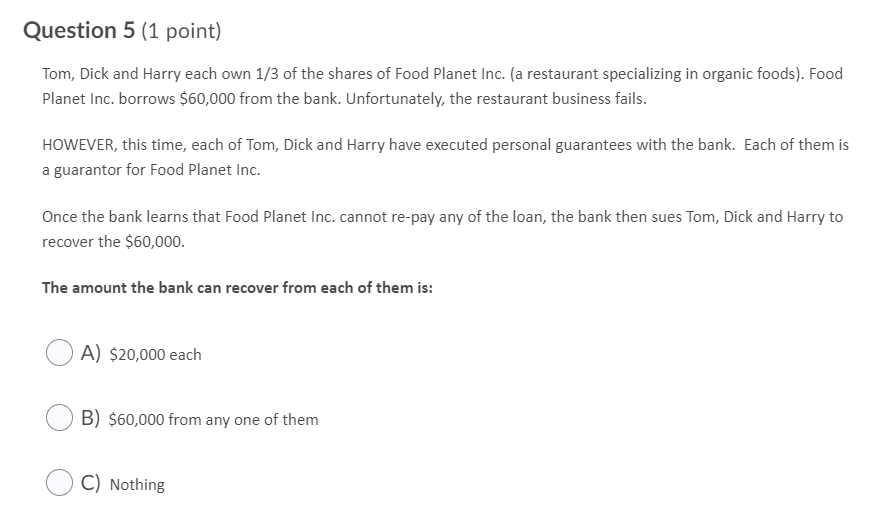

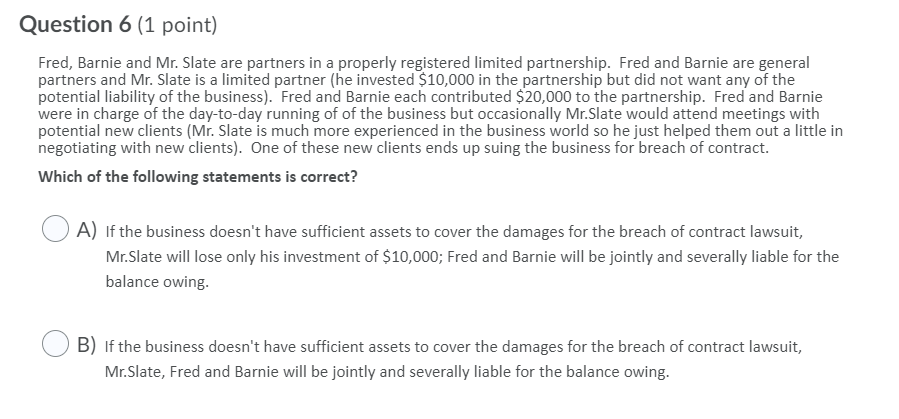

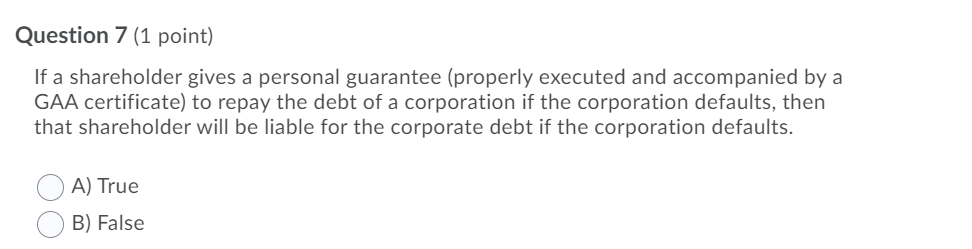

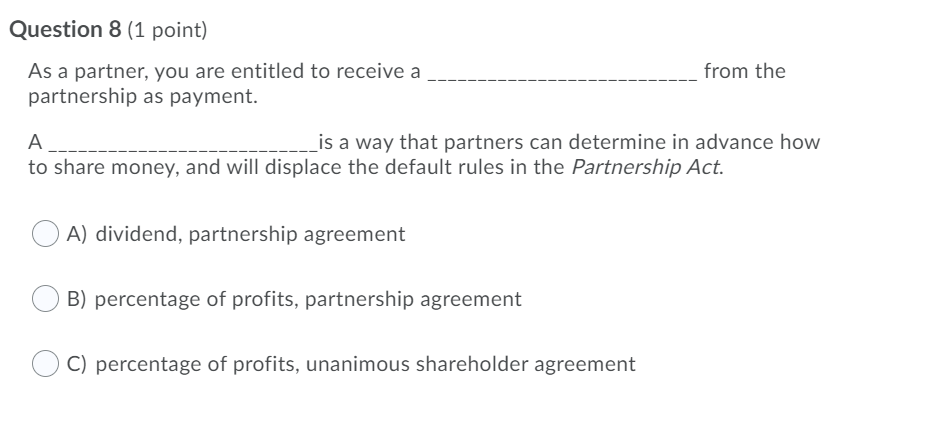

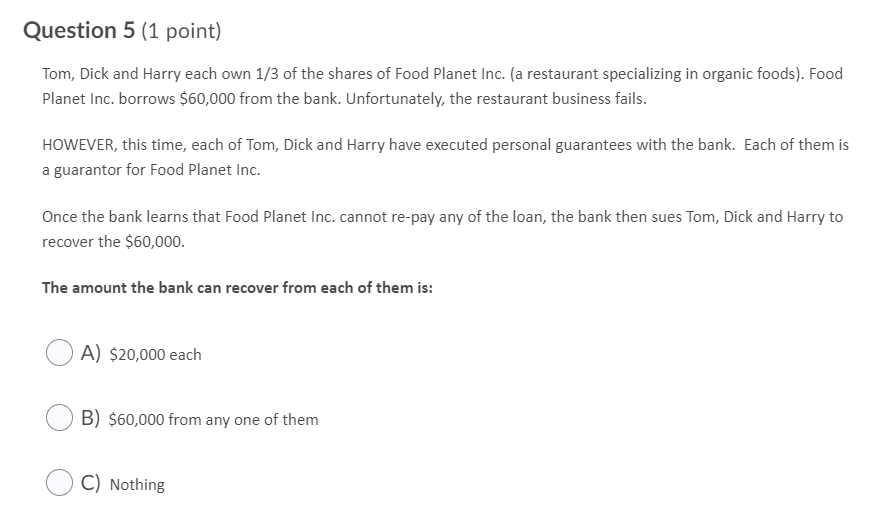

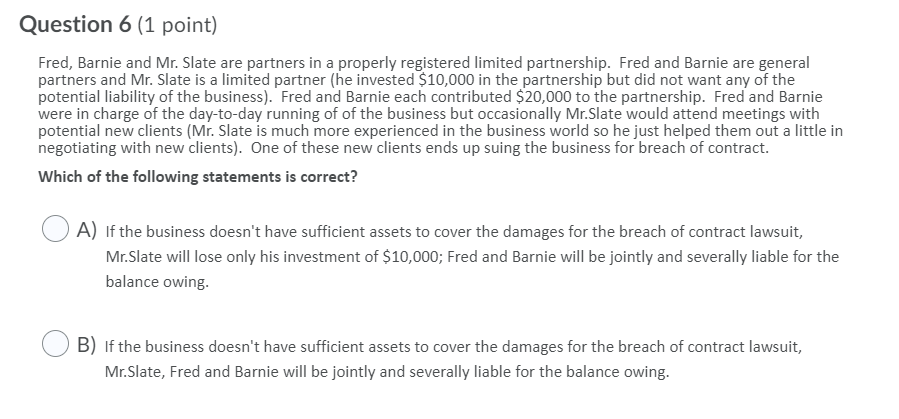

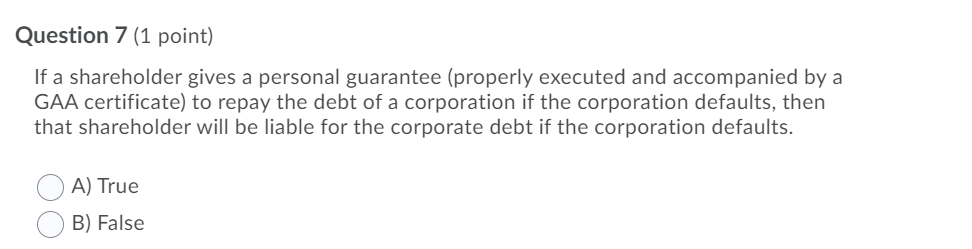

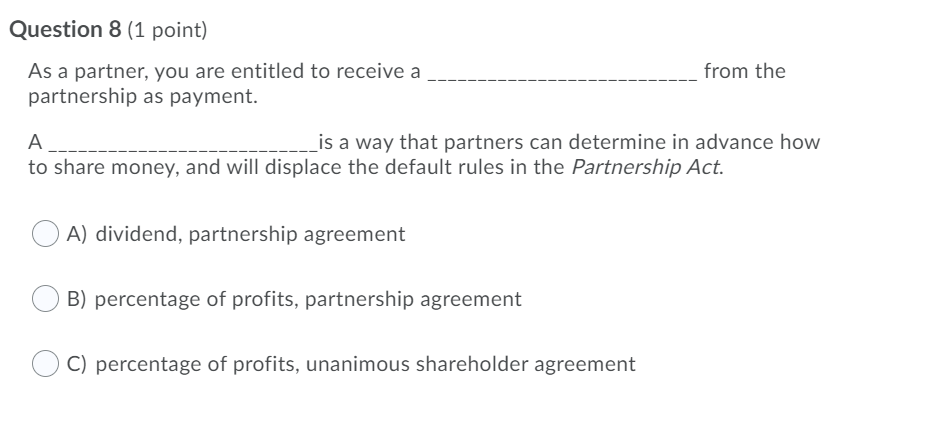

Question 5 (1 point) Tom, Dick and Harry each own 1/3 of the shares of Food Planet Inc. (a restaurant specializing in organic foods). Food Planet Inc. borrows $60,000 from the bank. Unfortunately, the restaurant business fails. HOWEVER, this time, each of Tom, Dick and Harry have executed personal guarantees with the bank. Each of them is a guarantor for Food Planet Inc. Once the bank learns that Food Planet Inc. cannot re-pay any of the loan, the bank then sues Tom, Dick and Harry to recover the $60,000. The amount the bank can recover from each of them is: A) $20,000 each B) $60,000 from any one of them C) Nothing Question 6 (1 point) Fred, Barnie and Mr. Slate are partners in a properly registered limited partnership. Fred and Barnie are general partners and Mr. Slate is a limited partner (he invested $10,000 in the partnership but did not want any of the potential liability of the business). Fred and Barnie each contributed $20,000 to the partnership. Fred and Barnie were in charge of the day-to-day running of of the business but occasionally Mr.Slate would attend meetings with potential new clients (Mr. Slate is much more experienced in the business world so he just helped them out a little in negotiating with new clients). One of these new clients ends up suing the business for breach of contract. Which of the following statements is correct? A) If the business doesn't have sufficient assets to cover the damages for the breach of contract lawsuit, Mr.Slate will lose only his investment of $10,000; Fred and Barnie will be jointly and severally liable for the balance owing. B) If the business doesn't have sufficient assets to cover the damages for the breach of contract lawsuit, Mr.Slate, Fred and Barnie will be jointly and severally liable for the balance owing. Question 7 (1 point) If a shareholder gives a personal guarantee (properly executed and accompanied by a GAA certificate) to repay the debt of a corporation if the corporation defaults, then that shareholder will be liable for the corporate debt if the corporation defaults. A) True B) False Question 8 (1 point) As a partner, you are entitled to receive a partnership as payment. from the . is a way that partners can determine in advance how to share money, and will displace the default rules in the Partnership Act. A) dividend, partnership agreement B) percentage of profits, partnership agreement OC) percentage of profits, unanimous shareholder agreement