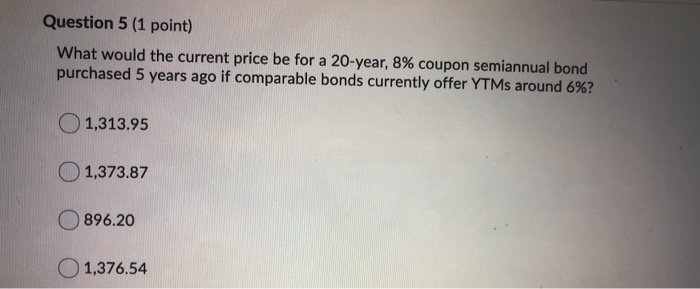

Question: Question 5 (1 point) What would the current price be for a 20-year, 8% coupon semiannual bond purchased 5 years ago if comparable bonds currently

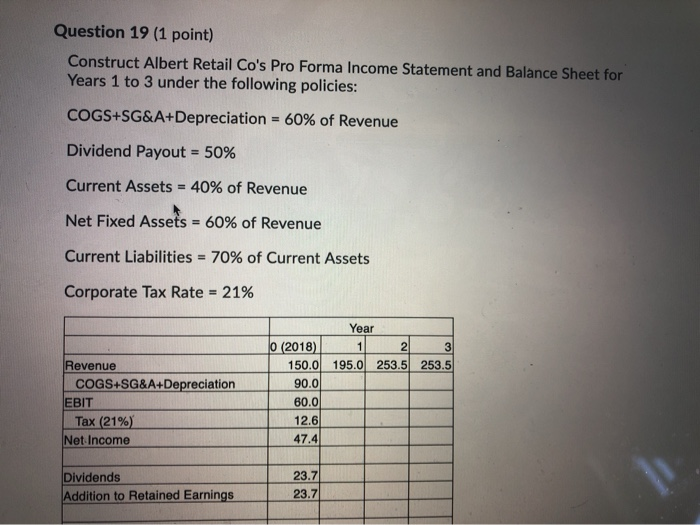

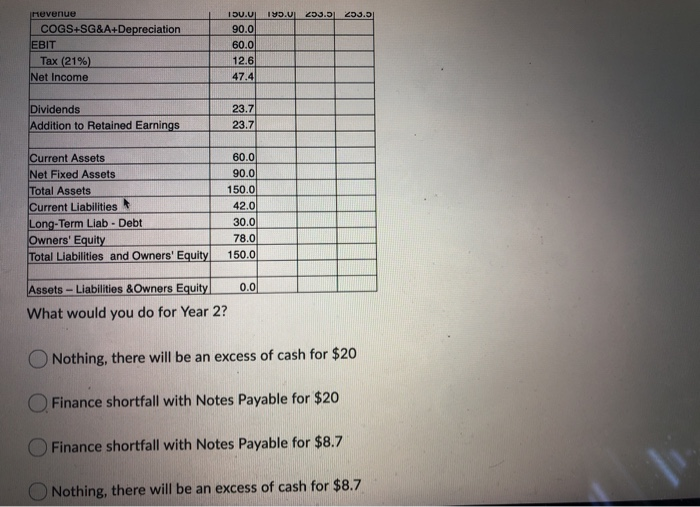

Question 5 (1 point) What would the current price be for a 20-year, 8% coupon semiannual bond purchased 5 years ago if comparable bonds currently offer YTMs around 6%?! 1,313.95 1,373.87 896.20 1,376.54 Question 19 (1 point) Construct Albert Retail Co's Pro Forma Income Statement and Balance Sheet for Years 1 to 3 under the following policies: COGS+SG&A+Depreciation = 60% of Revenue Dividend Payout = 50% Current Assets = 40% of Revenue Net Fixed Assets = 60% of Revenue Current Liabilities = 70% of Current Assets Corporate Tax Rate = 21% Year 195.0 253.5 253.5 Revenue COGS+SG&A+Depreciation EBIT Tax (21%) Net Income O (2018) 150.0 90.0 60.0 12.6 47.4 Dividends Addition to Retained Earnings 23.7 23.7 195. 253. 253.5 revenue COGS+SG&A+Depreciation EBIT Tax (21%) Net Income 1DU.U 90.0 60.0 12.6 47.4 Dividends Addition to Retained Earnings 23.7 23.7 Current Assets Net Fixed Assets Total Assets Current Liabilities Long-Term Liab - Debt Owners' Equity Total Liabilities and Owners' Equity 60.0 90.0 150.0 42.0 30.0 78.0l 150.0 0.0 Assets - Liabilities &Owners Equity What would you do for Year 2? O Nothing, there will be an excess of cash for $20 O Finance shortfall with Notes Payable for $20 Finance shortfall with Notes Payable for $8.7 O Nothing, there will be an excess of cash for $8.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts