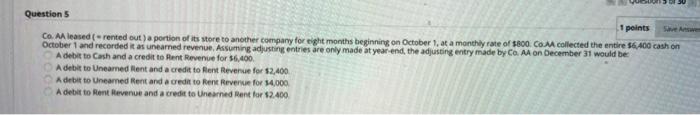

Question: Question 5 1 points Co. Aleased rented out a portion of its store to another company foreight months beginning on October 1, at a monthly

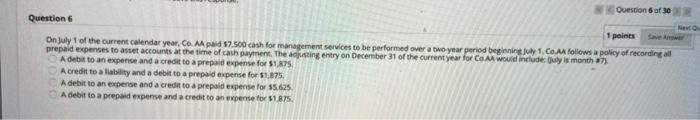

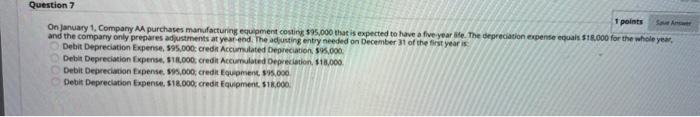

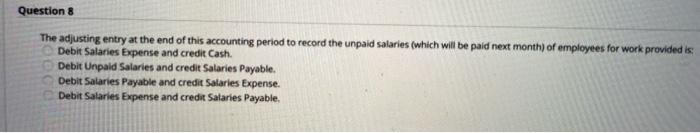

Question 5 1 points Co. Aleased rented out a portion of its store to another company foreight months beginning on October 1, at a monthly rate of $800.COM collected the entire 56, 400 cash on October 1 and recorded it as unearned revenue Assuming adjusting entries are only made at year-end, the adjusting entry made by Co. AA on December 31 would be Adebit to Cash and a credit to Rent Revenue for $6,400 Adebit to Unearned Hent and a credit to Rent Revenue for $2,400 Adebito Unearned Rent and a credit to Rent Revenue for 14,000 A debit to Rent Revenue and a credit to Unearned Rent for $2.400 Question of 30 Question 6 1 points On July of the current calendar year, Co. Mpaid 57.500 cash for management services to be performed over a two year period beginningu 1. Co A follows a policy of recording all prepaid expenses to asset accounts at the time of cash payment. The adjusting entry on December 31 of the current year for CoA would include yis month 87) A debit to an expense and a credit to a prepaid expense for $1.75. Acredit to a liability and a debit to a prepaid expense for $1.275 A debit to an expense and a credit to a prepaid expense for 55.625 A debit to a prepaid expense and a credit to an expense for $1.875 Question 7 1 points On January 1, Company MA purchases manufacturing equipment costing 595,000 that is expected to have a five year. The depreciation expense quals $18.000 for the whole year, and the company only prepares adjustments at year end. The adjusting entry needed on December 31 of the first year is Debit Depreciation Expense. 595,000 credit Accumulated Depreciation 395.000 Debit Depreciation Expense, 11000 credit Accumulated Depreciation, $18,000 Debit Depreciation Expense 395.000 credit fquament 95.000 Debit Depreciation Expense, $18.000 credit Equipment. $18.000 Question 8 The adjusting entry at the end of this accounting period to record the unpaid salaries (which will be paid next month) of employees for work provided is: Debit Salaries Expense and credit Cash. Debit Unpaid Salaries and credit Salaries Payable. Debit Salaries Payable and credit Salaries Expense. Debit Salaries Expense and credit Salaries Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts