Question: Question 5 1 pts A bond has a par value of $10,000. It matures in 15 years. The bond has a coupon rate of 7%,

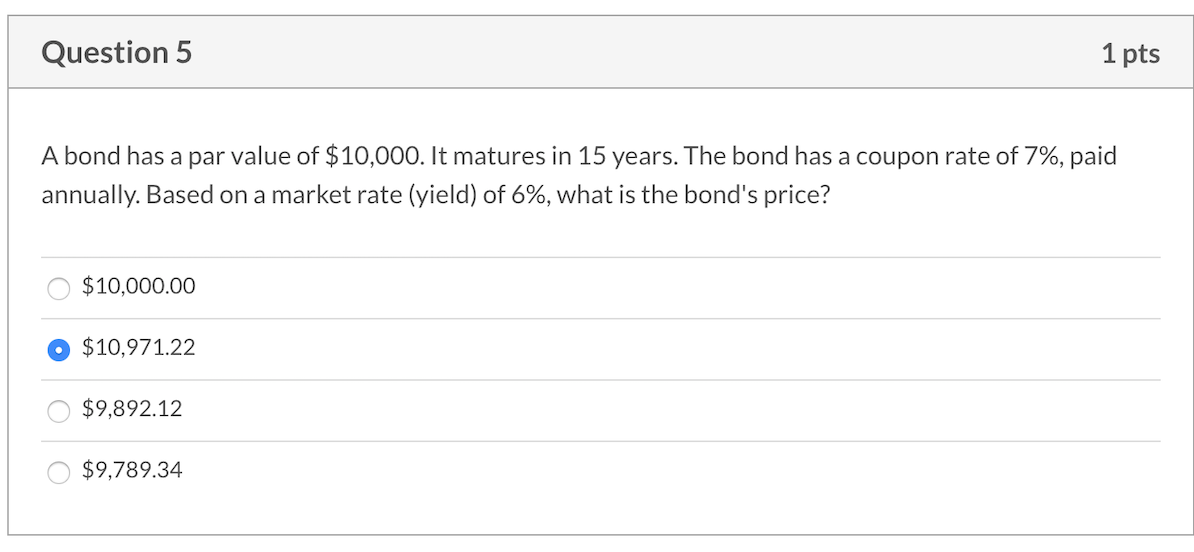

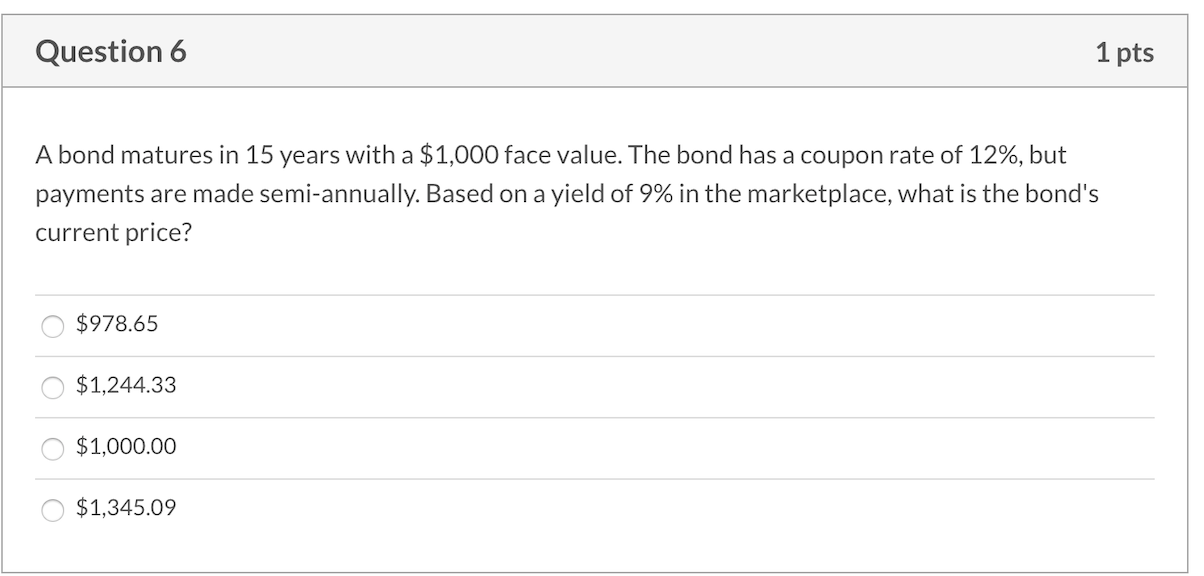

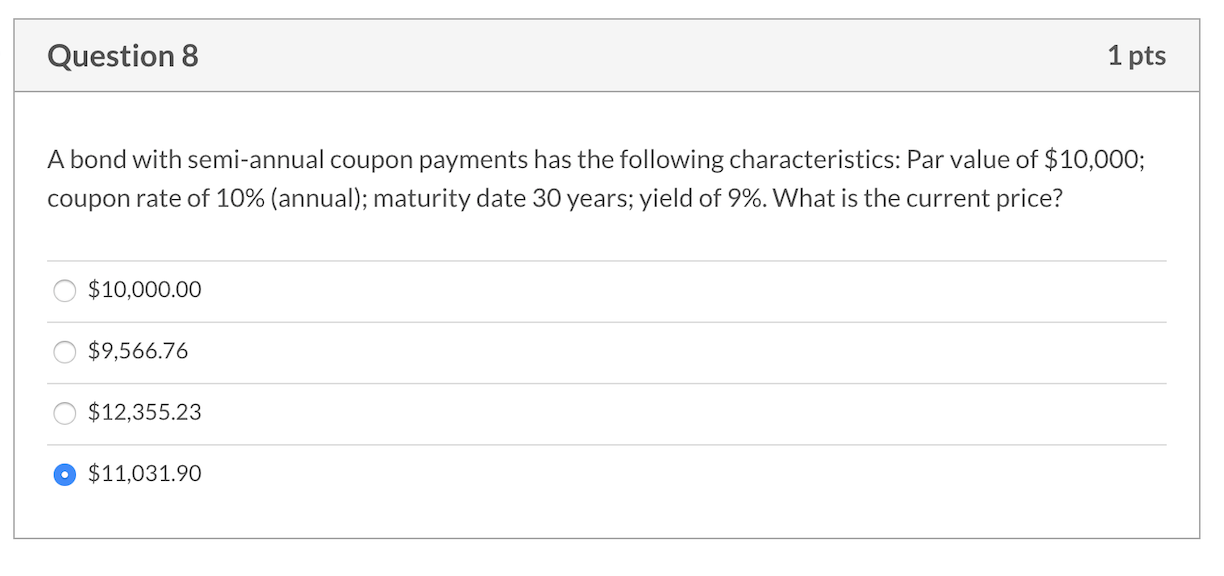

Question 5 1 pts A bond has a par value of $10,000. It matures in 15 years. The bond has a coupon rate of 7%, paid annually. Based on a market rate (yield) of 6%, what is the bond's price? 0 $10,000.00 $10,971.22 0 $9,892.12 0 $9,789.34 Question 6 1 pts A bond matures in 15 years with a $1,000 face value. The bond has a coupon rate of 12%, but payments are made semi-annually. Based on a yield of 9% in the marketplace, what is the bond's current price? O $978.65 0 $1,244.33 0 $1,000.00 0 $1,345.09 Question 8 1 pts A bond with semi-annual coupon payments has the following characteristics: Par value of $10,000; coupon rate of 10% (annual); maturity date 30 years; yield of 9%. What is the current price? O $10,000.00 O $9,566.76 O $12,355.23 O $11,031.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts