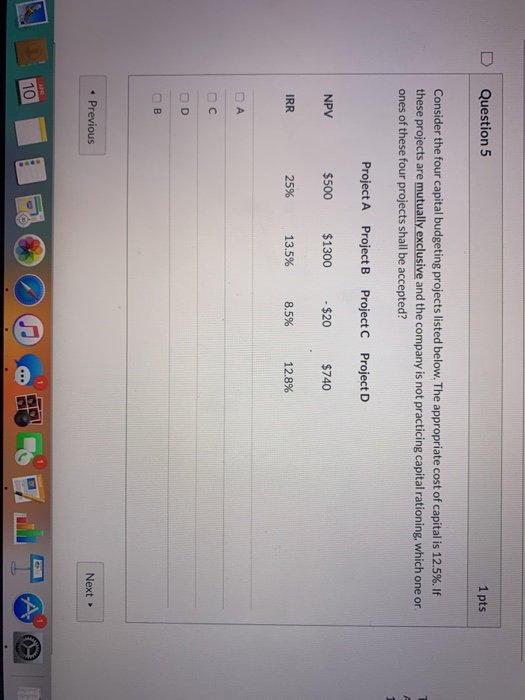

Question: Question 5 1 pts Consider the four capital budgeting projects listed below. The appropriate cost of capital is 12.5%. If these projects are mutually exclusive

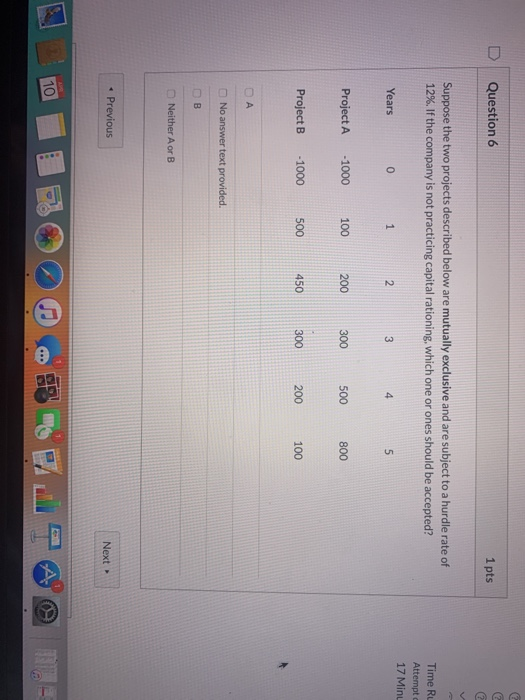

Question 5 1 pts Consider the four capital budgeting projects listed below. The appropriate cost of capital is 12.5%. If these projects are mutually exclusive and the company is not practicing capital rationing, which one or ones of these four projects shall be accepted? Project A Project B Project C Project D NPV $500 $1300 - $20 $740 IRR 25% 13.5% 8.5% 12.8% OD OB Previous Next 1 pts Question 6 Suppose the two projects described below are mutually exclusive and are subject to a hurdle rate of 12%. If the company is not practicing capital rationing, which one or ones should be accepted? Time R Attempt 17 Mini Years 0 1 2 3 Project A - 1000 100 200 500 800 Project B -1000 500 450 200 100 No answer text provided. Neither A or B Next - Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts