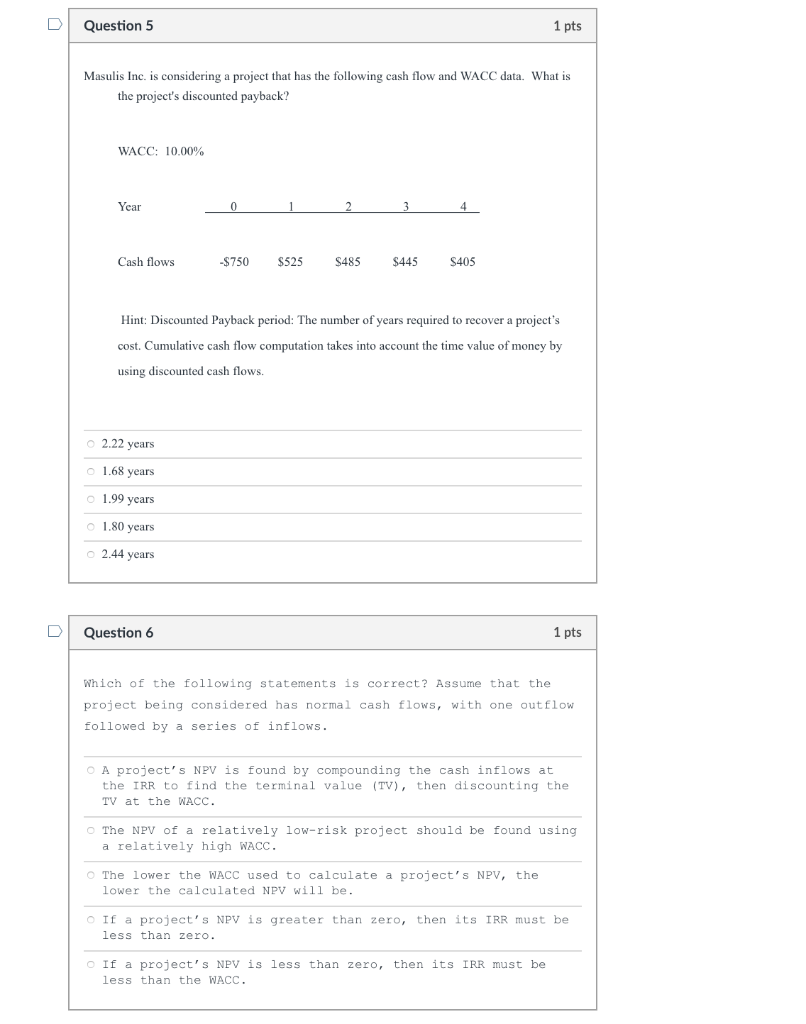

Question: Question 5 1 pts Masulis Inc. is considering a project that has the following cash flow and WACC data. What is the project's discounted payback?

Question 5 1 pts Masulis Inc. is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.00% Year 2 3 4 Cash flows -$750 $525 S485 $445 S405 Hint: Discounted Payback period: The number of years required to recover a project's cost. Cumulative cash flow computation takes into account the time value of money by using discounted cash flows. 2.22 years 1.68 years 1.99 years 1.80 years 2.44 years U Question 6 1 pts Which of the following statements is correct? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. O A project's NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV), then discounting the TV at the WACC. The NPV of a relatively low-risk project should be found using a relatively high WACC. The lower the WACC used to calculate a project's NPV, the lower the calculated NPV will be. If a project's NPV is greater than zero, then its IRR must be less than zero. If a project's NPV is less than zero, then its IRR must be less than the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts