Question: Question 5 1 pts Suppose the same client in the previous problem decides to invest in your risky portfolio a proportion (y) of his total

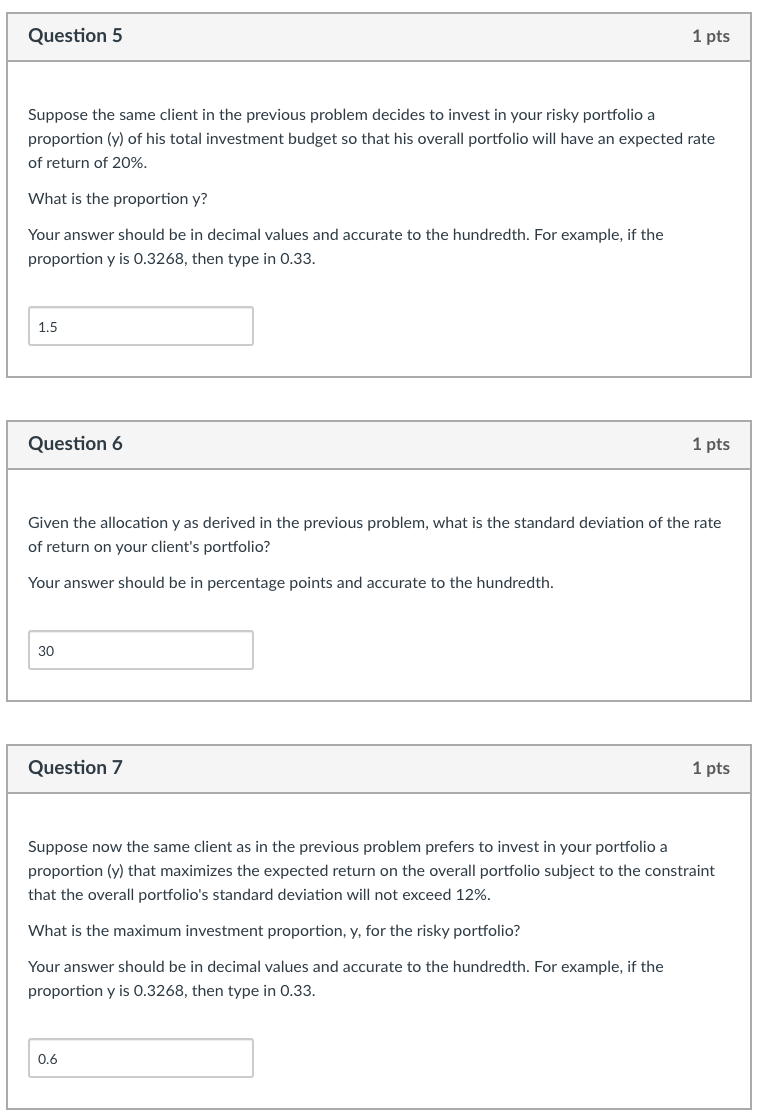

Question 5 1 pts Suppose the same client in the previous problem decides to invest in your risky portfolio a proportion (y) of his total investment budget so that his overall portfolio will have an expected rate of return of 20%. What is the proportion y? Your answer should be in decimal values and accurate to the hundredth. For example, if the proportion y is 0.3268, then type in 0.33. 1.5 Question 6 1 pts Given the allocation y as derived in the previous problem, what is the standard deviation of the rate of return on your client's portfolio? Your answer should be in percentage points and accurate to the hundredth. 30 Question 7 1 pts Suppose now the same client as in the previous problem prefers to invest in your portfolio a proportion (y) that maximizes the expected return on the overall portfolio subject to the constraint that the overall portfolio's standard deviation will not exceed 12%. What is the maximum investment proportion, y, for the risky portfolio? Your answer should be in decimal values and accurate to the hundredth. For example, if the proportion y is 0.3268, then type in 0.33. 0.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts