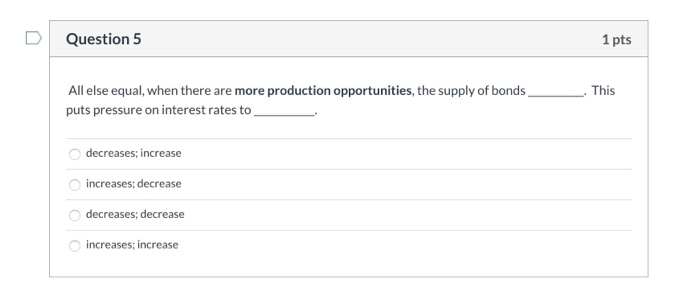

Question: Question 5 1 pts . This All else equal, when there are more production opportunities, the supply of bonds puts pressure on interest rates to

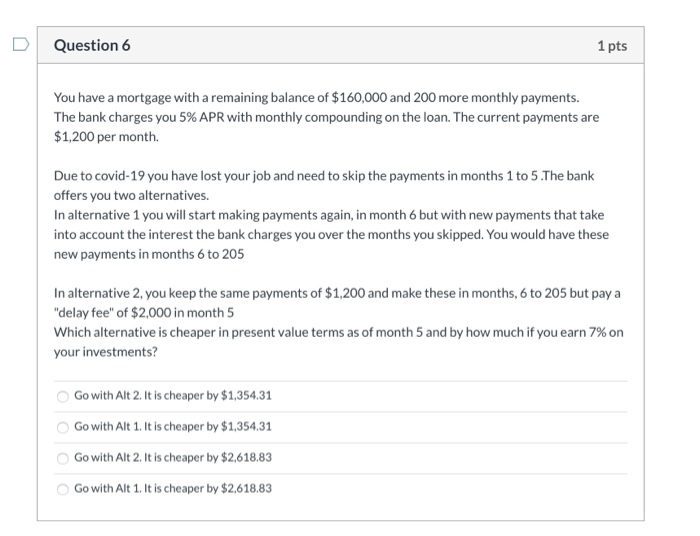

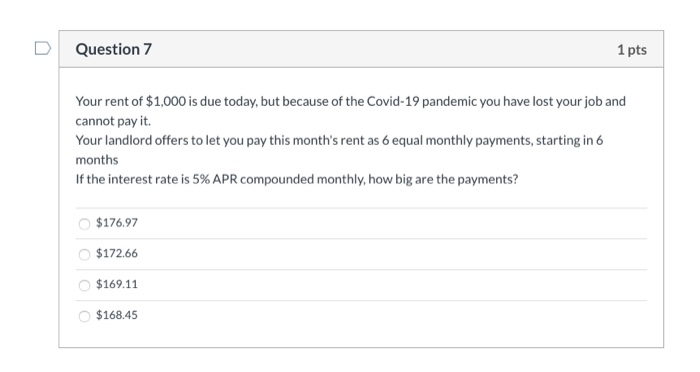

Question 5 1 pts . This All else equal, when there are more production opportunities, the supply of bonds puts pressure on interest rates to decreases; increase increases; decrease decreases; decrease increases; increase Question 6 1 pts You have a mortgage with a remaining balance of $160,000 and 200 more monthly payments. The bank charges you 5% APR with monthly compounding on the loan. The current payments are $1,200 per month Due to covid-19 you have lost your job and need to skip the payments in months 1 to 5.The bank offers you two alternatives. In alternative 1 you will start making payments again, in month 6 but with new payments that take into account the interest the bank charges you over the months you skipped. You would have these new payments in months 6 to 205 In alternative 2, you keep the same payments of $1,200 and make these in months, 6 to 205 but pay a "delay fee" of $2,000 in month 5 Which alternative is cheaper in present value terms as of month 5 and by how much if you earn 7% on your investments? Go with Alt 2. It is cheaper by $1,354.31 Go with Alt 1. It is cheaper by $1,354.31 Go with Alt 2. It is cheaper by $2,618.83 Go with Alt 1. It is cheaper by $2,618.83 Question 7 1 pts Your rent of $1,000 is due today, but because of the Covid-19 pandemic you have lost your job and cannot pay it. Your landlord offers to let you pay this month's rent as 6 equal monthly payments, starting in 6 months If the interest rate is 5% APR compounded monthly, how big are the payments? $176.97 $172.66 $169.11 $168.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts