Question: Question 5 1 pts What is the CAPM implied expected return on a stock with: Beta is 0.78 Market Risk Premium is 10% Risk-free Rate

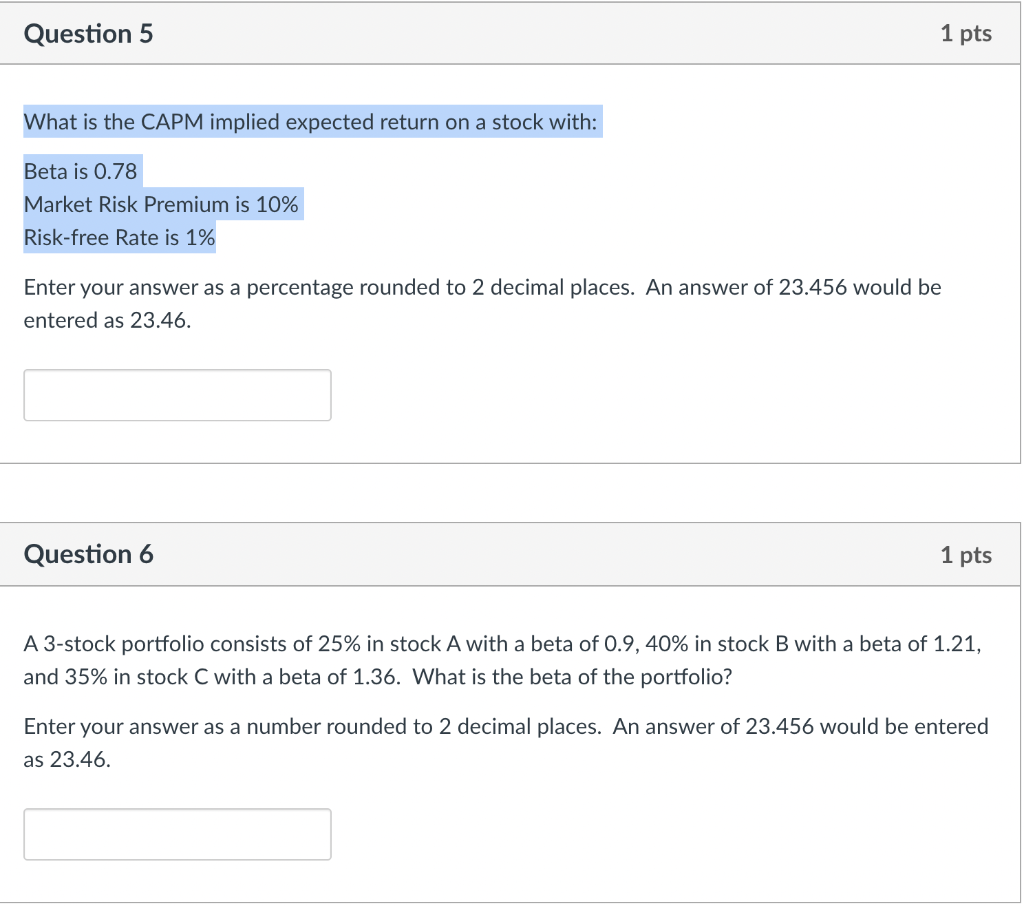

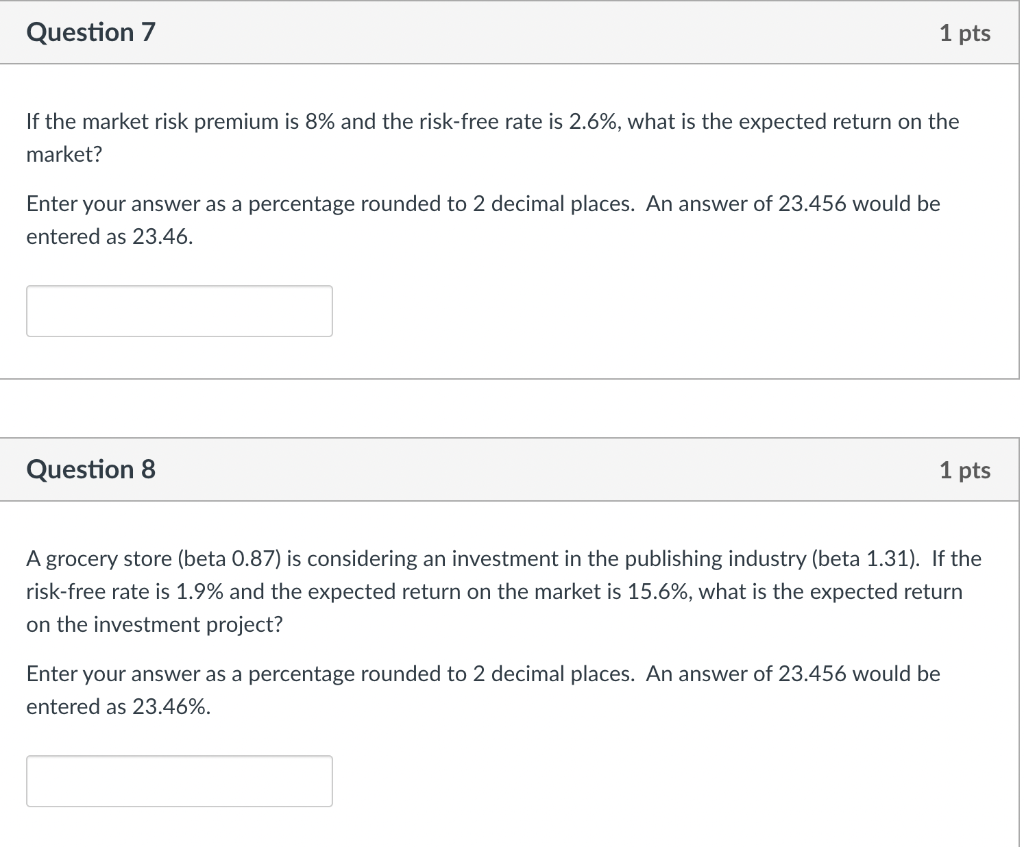

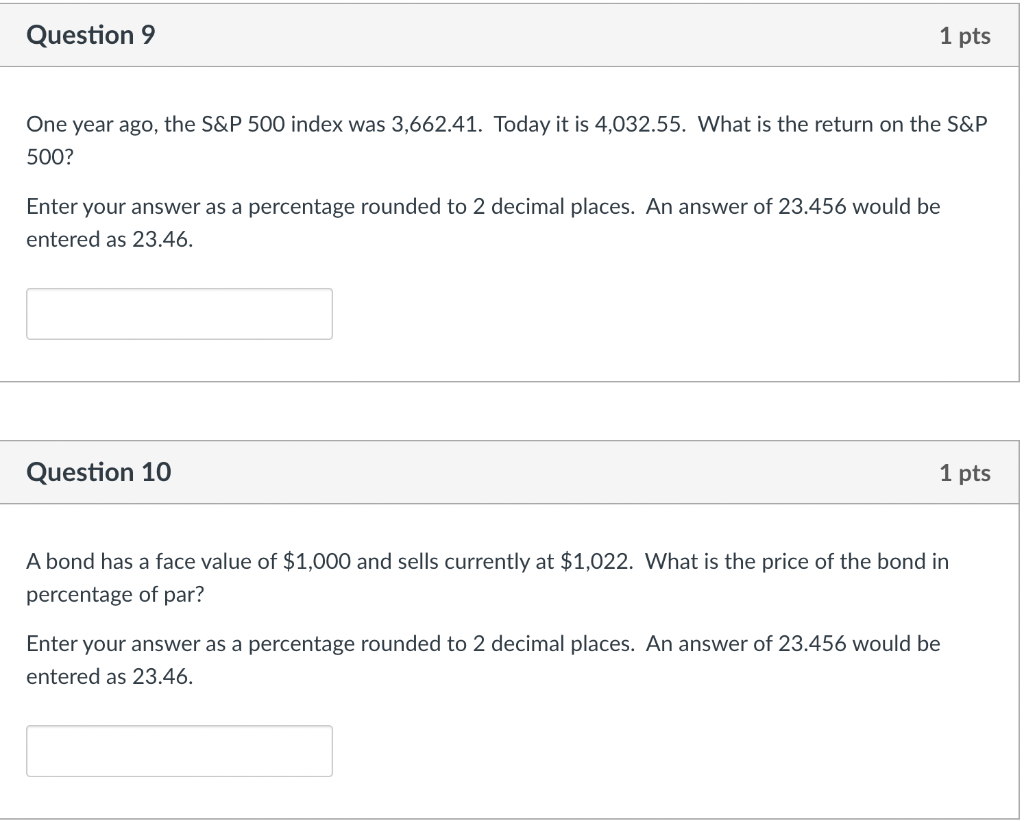

Question 5 1 pts What is the CAPM implied expected return on a stock with: Beta is 0.78 Market Risk Premium is 10% Risk-free Rate is 1% Enter your answer as a percentage rounded to 2 decimal places. An answer of 23.456 would be entered as 23.46. Question 6 1 pts A 3-stock portfolio consists of 25% in stock A with a beta of 0.9, 40% in stock B with a beta of 1.21, and 35% in stock C with a beta of 1.36. What is the beta of the portfolio? Enter your answer as a number rounded to 2 decimal places. An answer of 23.456 would be entered as 23.46. Question 7 1 pts If the market risk premium is 8% and the risk-free rate is 2.6%, what is the expected return on the market? Enter your answer as a percentage rounded to 2 decimal places. An answer of 23.456 would be entered as 23.46. Question 8 1 pts A grocery store (beta 0.87) is considering an investment in the publishing industry (beta 1.31). If the risk-free rate is 1.9% and the expected return on the market is 15.6%, what is the expected return on the investment project? Enter your answer as a percentage rounded to 2 decimal places. An answer of 23.456 would be entered as 23.46%. Question 9 1 pts One year ago, the S&P 500 index was 3,662.41. Today it is 4,032.55. What is the return on the S&P 500? Enter your answer as a percentage rounded to 2 decimal places. An answer of 23.456 would be entered as 23.46. Question 10 1 pts A bond has a face value of $1,000 and sells currently at $1,022. What is the price of the bond in percentage of par? Enter your answer as a percentage rounded to 2 decimal places. An answer of 23.456 would be entered as 23.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts