Question: QUESTION 5 (10 marks) (a) Explain whether a constant payout ratio policy or a constant dollar payout policy for paying dividends would best suit a

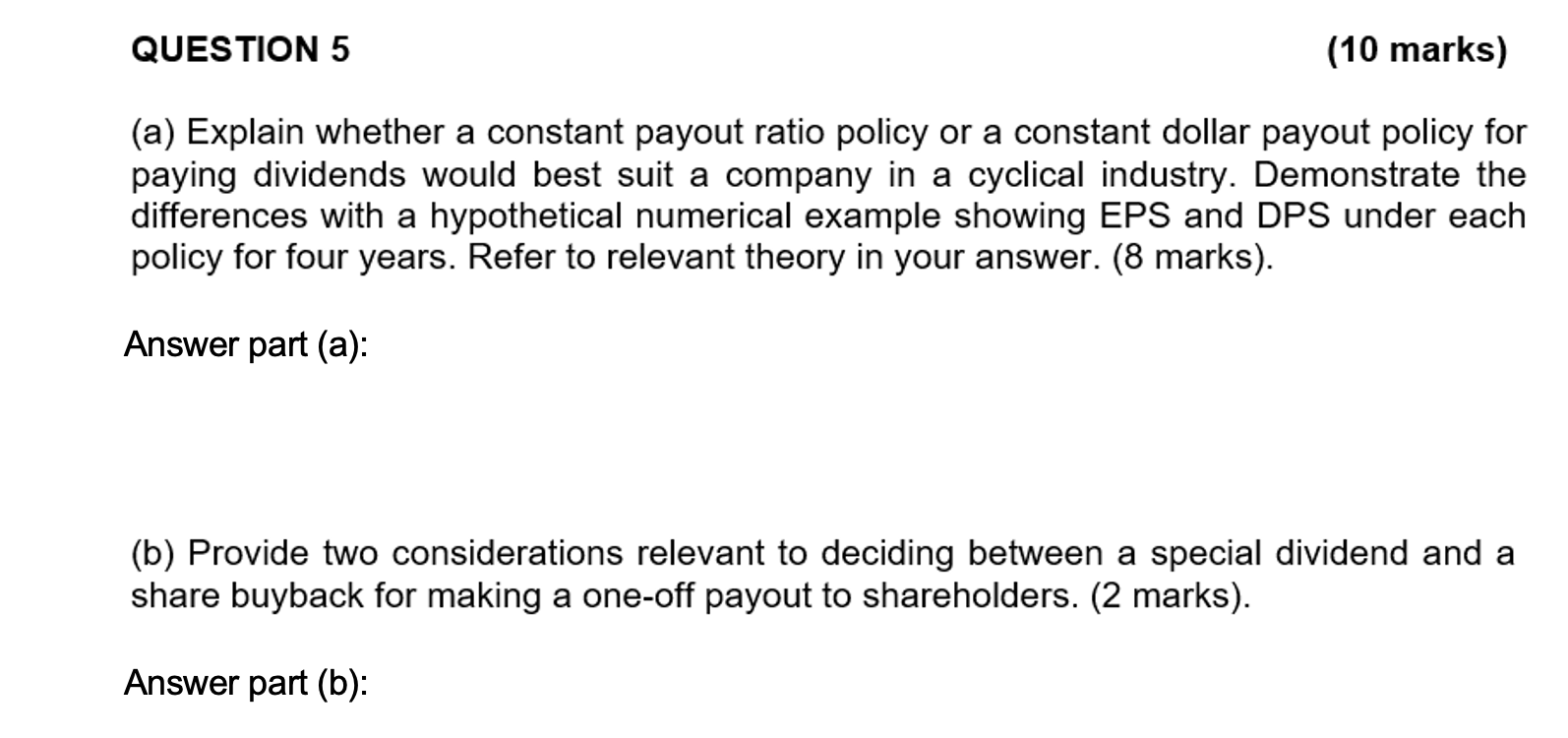

QUESTION 5 (10 marks) (a) Explain whether a constant payout ratio policy or a constant dollar payout policy for paying dividends would best suit a company in a cyclical industry. Demonstrate the differences with a hypothetical numerical example showing EPS and DPS under each policy for four years. Refer to relevant theory in your answer. (8 marks). Answer part (a): (b) Provide two considerations relevant to deciding between a special dividend and a share buyback for making a one-off payout to shareholders. (2 marks). Answer part (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts