Question: Question 5 (10 marks) Read the scenario below and answer the questions that follow: Investor A considers investing in the Financial Times Stock Exchange/Johannesburg Stock

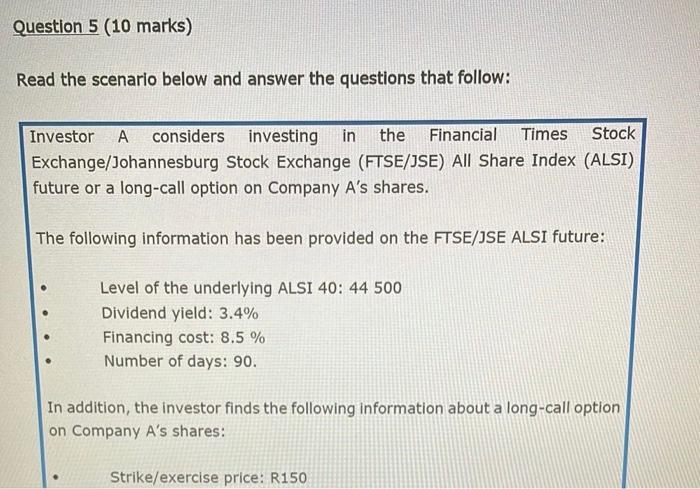

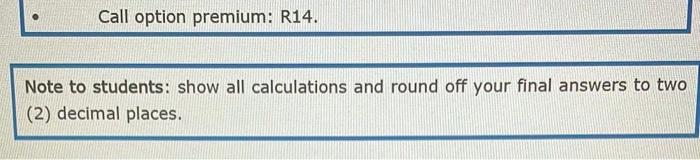

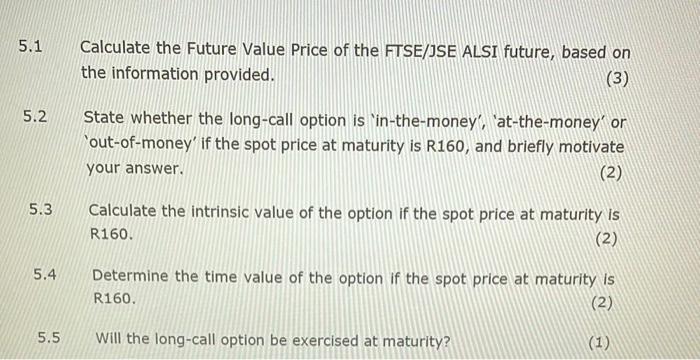

Question 5 (10 marks) Read the scenario below and answer the questions that follow: Investor A considers investing in the Financial Times Stock Exchange/Johannesburg Stock Exchange (FTSE/JSE) All Share Index (ALSI) future or a long-call option on Company A's shares. The following information has been provided on the FTSE/JSE ALSI future: Level of the underlying ALSI 40: 44 500 Dividend yield: 3.4% Financing cost: 8.5 % Number of days: 90. In addition, the investor finds the following information about a long-call option on Company A's shares: Strike/exercise price: R150 Call option premium: R14. Note to students: show all calculations and round off your final answers to two (2) decimal places. 5.1 Calculate the Future Value Price of the FTSE/JSE ALSI future, based on the information provided. (3) 5.2 State whether the long-call option is 'in-the-money', 'at-the-money' or 'out-of-money' if the spot price at maturity is R160, and briefly motivate your answer. (2) 5.3 Calculate the intrinsic value of the option if the spot price at maturity is R160. (2) Determine the time value of the option if the spot price at maturity is R160. (2) 5.4 5.5 Will the long-call option be exercised at maturity? (1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts