Question: Question 5 (10 marks) The Rising Sun Ltd currently has 75 million shares outstanding. The shares sell for $6 per share. To raise $100 million

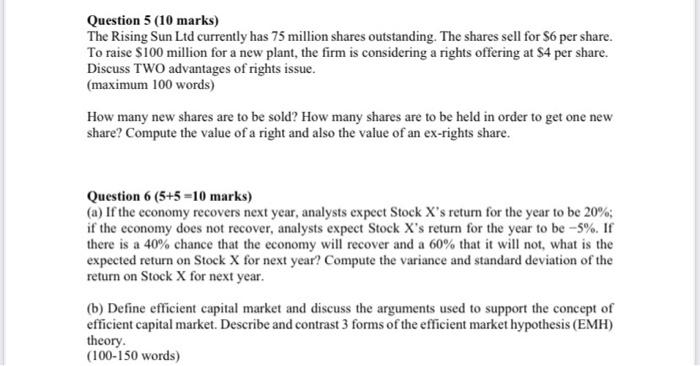

Question 5 (10 marks) The Rising Sun Ltd currently has 75 million shares outstanding. The shares sell for $6 per share. To raise $100 million for a new plant, the firm is considering a rights offering at $4 per share. Discuss TWO advantages of rights issue. (maximum 100 words) How many new shares are to be sold? How many shares are to be held in order to get one new share? Compute the value of a right and also the value of an ex-rights share. Question 6 (5+5=10 marks) (a) If the economy recovers next year, analysts expect Stock X's return for the year to be 20%; if the economy does not recover, analysts expect Stock X's return for the year to be -5%. If there is a 40% chance that the economy will recover and a 60% that it will not, what is the expected return on Stock X for next year? Compute the variance and standard deviation of the return on Stock X for next year. (b) Define efficient capital market and discuss the arguments used to support the concept of efficient capital market. Describe and contrast 3 forms of the efficient market hypothesis (EMH) theory. (100-150 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts