Question: QUESTION 5 (10 marks) This question consists of five multiple-choice questions. Each question must be considered independently, except where specific reference is made to information

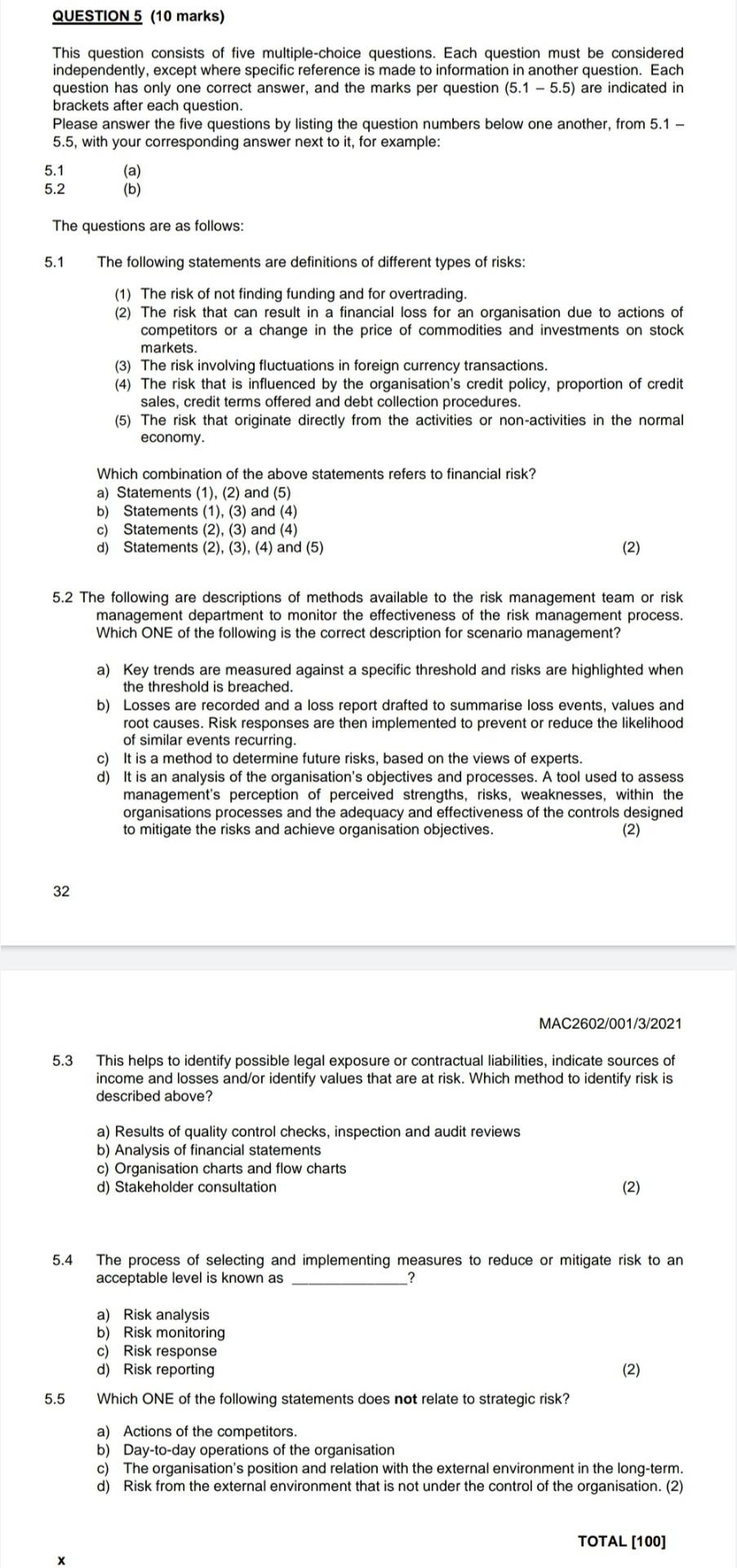

QUESTION 5 (10 marks) This question consists of five multiple-choice questions. Each question must be considered independently, except where specific reference is made to information in another question. Each question has only one correct answer, and the marks per question (5.1 -5.5) are indicated in brackets after each question. Please answer the five questions by listing the question numbers below one another, from 5.1 - 5.5, with your corresponding answer next to it, for example: 5.1 (a) 5.2 (b) The questions are as follows: 5.1 The following statements are definitions of different types of risks: (1) The risk of not finding funding and for overtrading. (2) The risk that can result in a financial loss for an organisation due to actions of competitors or a change in the price of commodities and investments on stock markets. (3) The risk involving fluctuations in foreign currency transactions. (4) The risk that is influenced by the organisation's credit policy, proportion of credit sales, credit terms offered and debt collection procedures. (5) The risk that originate directly from the activities or non-activities in the normal economy. Which combination of the above statements refers to financial risk? a) Statements (1), (2) and (5) b) Statements (1), (3) and (4) c) Statements (2), (3) and (4) d) Statements (2), (3), (4) and (5) (2) 5.2 The following are descriptions of methods available to the risk management team or risk management department to monitor the effectiveness of the risk management process. Which ONE of the following is the correct description for scenario management? a) Key trends are measured against a specific threshold and risks are highlighted when the threshold is breached. b) Losses are recorded and a loss report drafted to summarise loss events, values and root causes. Risk responses are then implemented to prevent or reduce the likelihood of similar events recurring. c) It is a method to determine future risks, based on the views of experts. d) It is an analysis of the organisation's objectives and processes. A tool used to assess management's perception of perceived strengths, risks, weaknesses, within the organisations processes and the adequacy and effectiveness of the controls designed to mitigate the risks and achieve organisation objectives. (2) 32 MAC2602/001/3/2021 5.3 This helps to identify possible legal exposure or contractual liabilities, indicate sources of income and losses and/or identify values that are at risk. Which method to identify risk is described above? a) Results of quality control checks, inspection and audit reviews b) Analysis of financial statements c) Organisation charts and flow charts d) Stakeholder consultation (2) 5.4 The process of selecting and implementing measures to reduce or mitigate risk to an acceptable level is known as a) Risk analysis b) Risk monitoring c) Risk response d) Risk reporting (2) 5.5 Which ONE of the following statements does not relate to strategic risk? a) Actions of the competitors. b) Day-to-day operations of the organisation c) The organisation's position and relation with the external environment in the long-term. d) Risk from the external environment that is not under the control of the organisation. (2) TOTAL [100]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts