Question: Question 5 (10 Marks) You work for a hedge fund known as Omicron Capital and are responsible for a portfolio which you strongly believe will

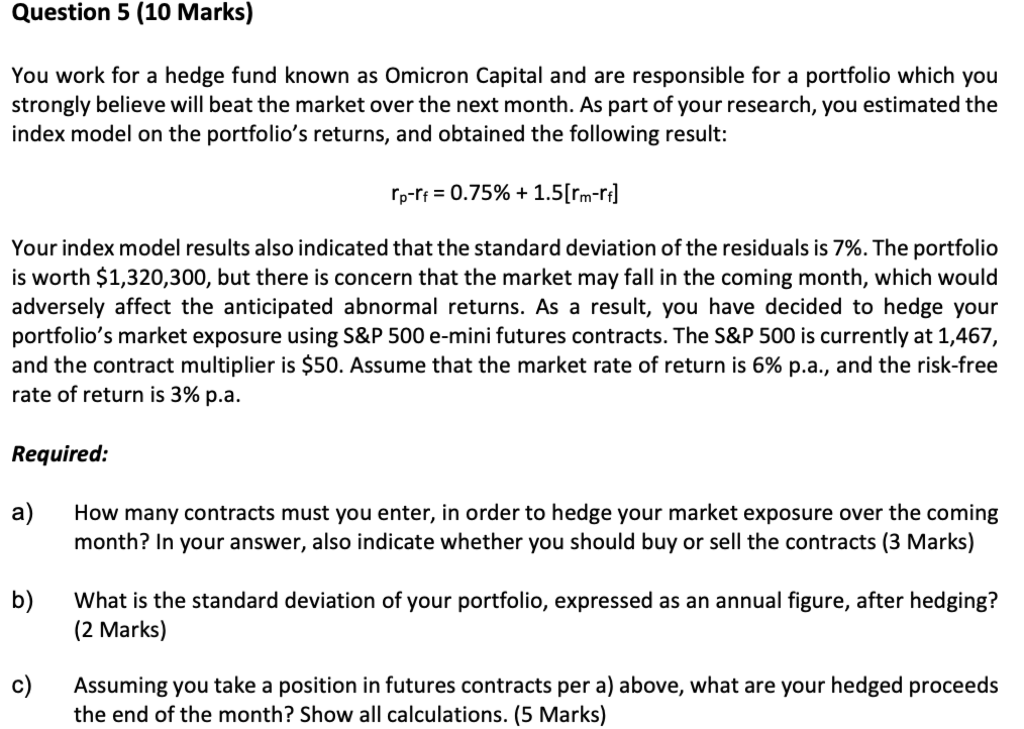

Question 5 (10 Marks) You work for a hedge fund known as Omicron Capital and are responsible for a portfolio which you strongly believe will beat the market over the next month. As part of your research, you estimated the index model on the portfolio's returns, and obtained the following result: rp-rt = 0.75% + 1.5[rm-rt] Your index model results also indicated that the standard deviation of the residuals is 7%. The portfolio is worth $1,320,300, but there is concern that the market may fall in the coming month, which would adversely affect the anticipated abnormal returns. As a result, you have decided to hedge your portfolio's market exposure using S&P 500 e-mini futures contracts. The S&P 500 is currently at 1,467, and the contract multiplier is $50. Assume that the market rate of return is 6% p.a., and the risk-free rate of return is 3% p.a. Required: a) How many contracts must you enter, in order to hedge your market exposure over the coming month? In your answer, also indicate whether you should buy or sell the contracts (3 Marks) b) What is the standard deviation of your portfolio, expressed as an annual figure, after hedging? (2 Marks) c) Assuming you take a position in futures contracts per a) above, what are your hedged proceeds the end of the month? Show all calculations. (5 Marks) Question 5 (10 Marks) You work for a hedge fund known as Omicron Capital and are responsible for a portfolio which you strongly believe will beat the market over the next month. As part of your research, you estimated the index model on the portfolio's returns, and obtained the following result: rp-rt = 0.75% + 1.5[rm-rt] Your index model results also indicated that the standard deviation of the residuals is 7%. The portfolio is worth $1,320,300, but there is concern that the market may fall in the coming month, which would adversely affect the anticipated abnormal returns. As a result, you have decided to hedge your portfolio's market exposure using S&P 500 e-mini futures contracts. The S&P 500 is currently at 1,467, and the contract multiplier is $50. Assume that the market rate of return is 6% p.a., and the risk-free rate of return is 3% p.a. Required: a) How many contracts must you enter, in order to hedge your market exposure over the coming month? In your answer, also indicate whether you should buy or sell the contracts (3 Marks) b) What is the standard deviation of your portfolio, expressed as an annual figure, after hedging? (2 Marks) c) Assuming you take a position in futures contracts per a) above, what are your hedged proceeds the end of the month? Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts