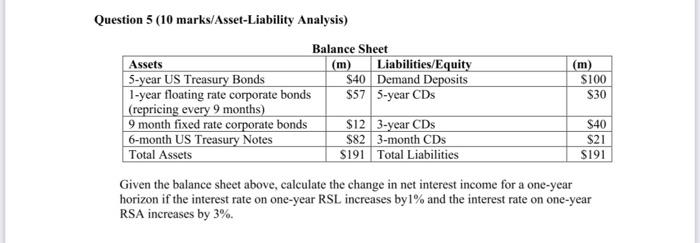

Question: Question 5 (10 marks/Asset-Liability Analysis) Balance Sheet Assets (m) Liabilities/Equity (m) 5-year US Treasury Bonds $40 Demand Deposits $100 1-year floating rate corporate bonds $57

Question 5 (10 marks/Asset-Liability Analysis) Balance Sheet Assets (m) Liabilities/Equity (m) 5-year US Treasury Bonds $40 Demand Deposits $100 1-year floating rate corporate bonds $57 5-year CDs $30 (repricing every 9 months) 9 month fixed rate corporate bonds $12 3-year CDs S40 6-month US Treasury Notes $82 3-month CDs $21 Total Assets $191 Total Liabilities S191 Given the balance sheet above, calculate the change in net interest income for a one-year horizon if the interest rate on one-year RSL increases byl% and the interest rate on one-year RSA increases by 3%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock