Question: Question 5 (10 points) 1) True or False: If a low-risk company invests in a high-risk project, the cash flows for the project should be

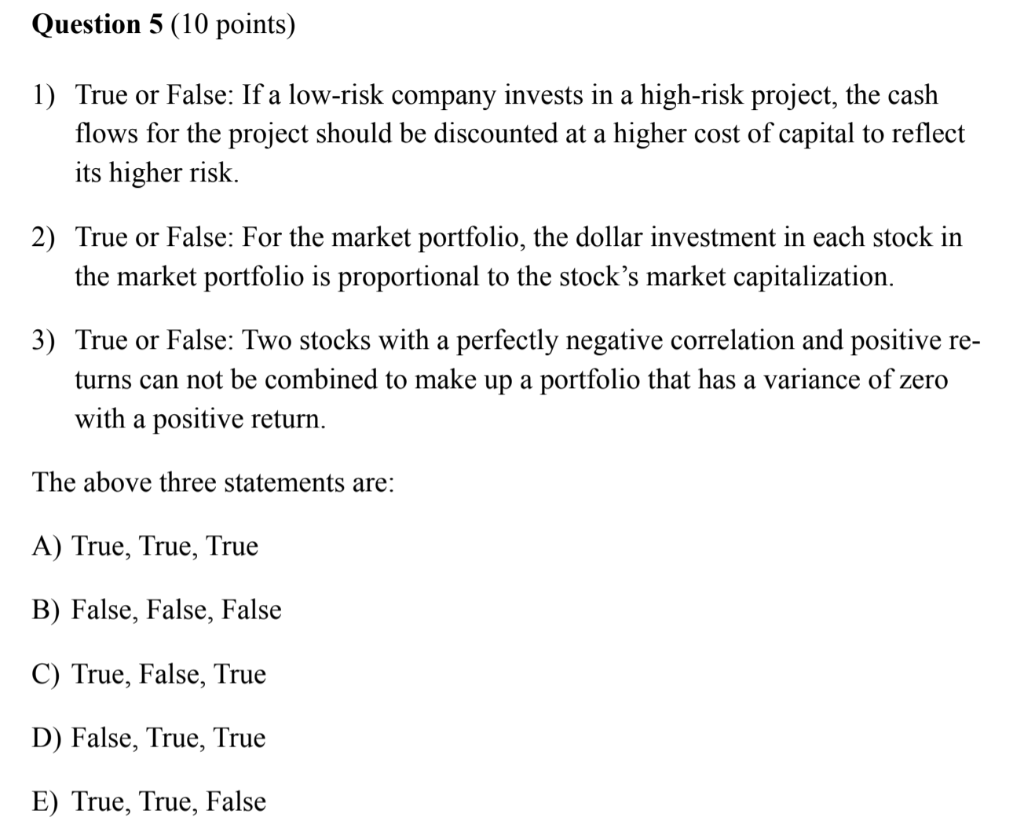

Question 5 (10 points) 1) True or False: If a low-risk company invests in a high-risk project, the cash flows for the project should be discounted at a higher cost of capital to reflect its higher risk 2) True or False: For the market portfolio, the dollar investment in each stock in the market portfolio is proportional to the stocks market capitalization. 3) True or False: Two stocks with a perfectly negative correlation and positive re- turns can not be combined to make up a portfolio that has a variance of zero with a positive return. The above three statements are: A) True, True, True B) False, False, False C) True, False, True D) False, True, True E) True, True, False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts