Question: Question 5 10 pts Cardinal Systems Co. plans to issue bonds with a par value of $1,000 and 20 years to maturity. These bonds will

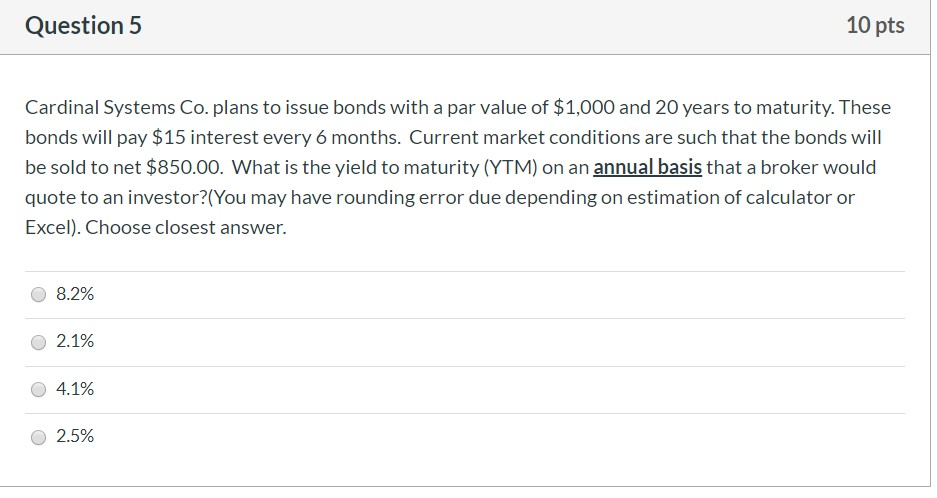

Question 5 10 pts Cardinal Systems Co. plans to issue bonds with a par value of $1,000 and 20 years to maturity. These bonds will pay $15 interest every 6 months. Current market conditions are such that the bonds will be sold to net $850.00. What is the yield to maturity (YTM) on an annual basis that a broker would quote to an investor?(You may have rounding error due depending on estimation of calculator or Excel). Choose closest answer. 8.2% 2.1% 4.1% 2.5%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock