Question: Question 5 10 pts Scampini Technologies is expected to generate $22.32 million in free cash flow next year, and its FCF is expected to grow

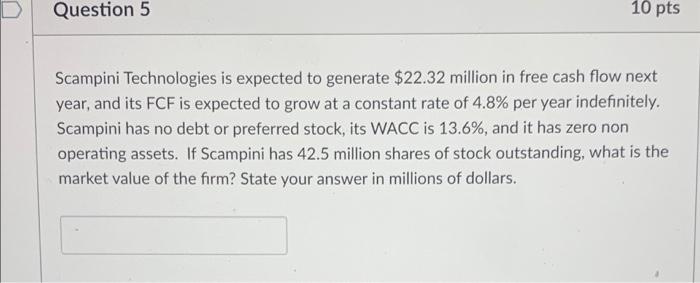

Question 5 10 pts Scampini Technologies is expected to generate $22.32 million in free cash flow next year, and its FCF is expected to grow at a constant rate of 4.8% per year indefinitely. Scampini has no debt or preferred stock, its WACC is 13.6%, and it has zero non operating assets. If Scampini has 42.5 million shares of stock outstanding, what is the market value of the firm? State your answer in millions of dollars

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock