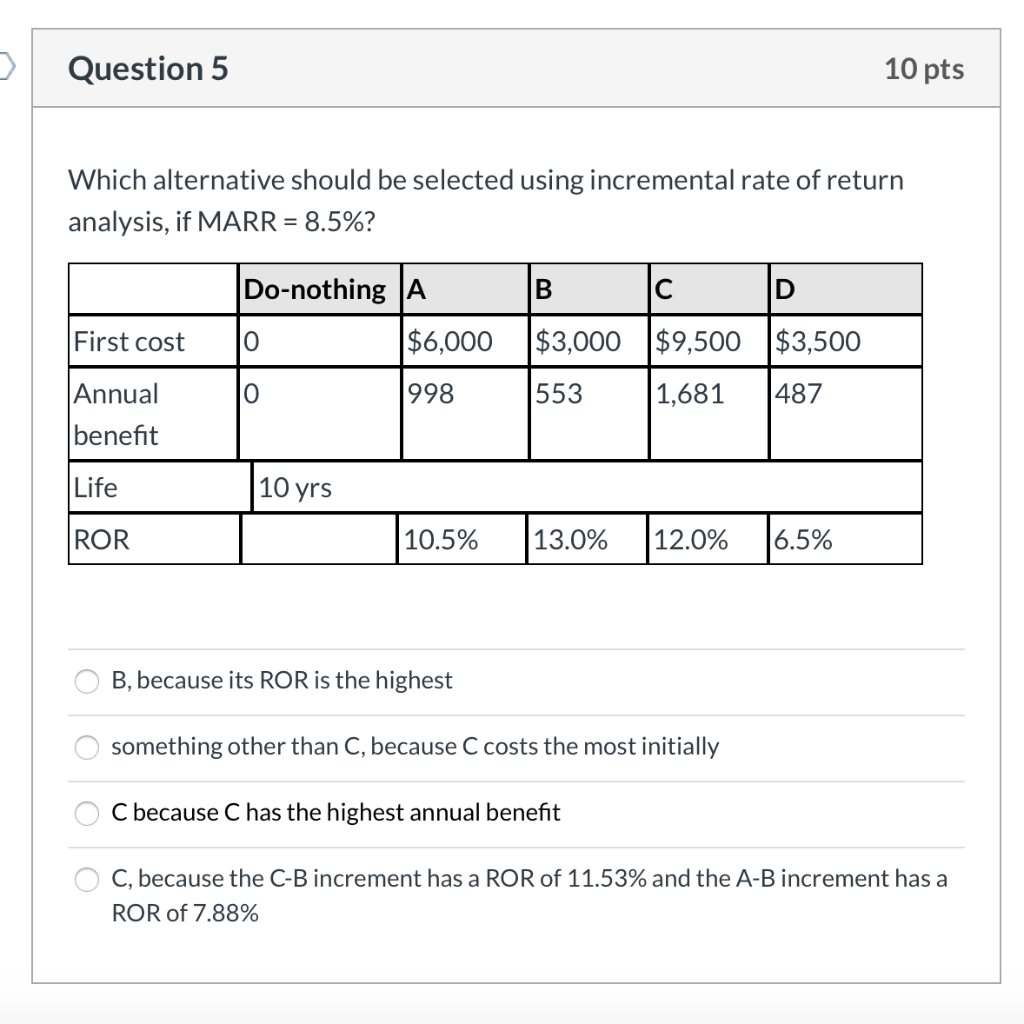

Question: Question 5 10 pts Which alternative should be selected using incremental rate of return analysis, if MARR = 8.5%? Do-nothing A B C D First

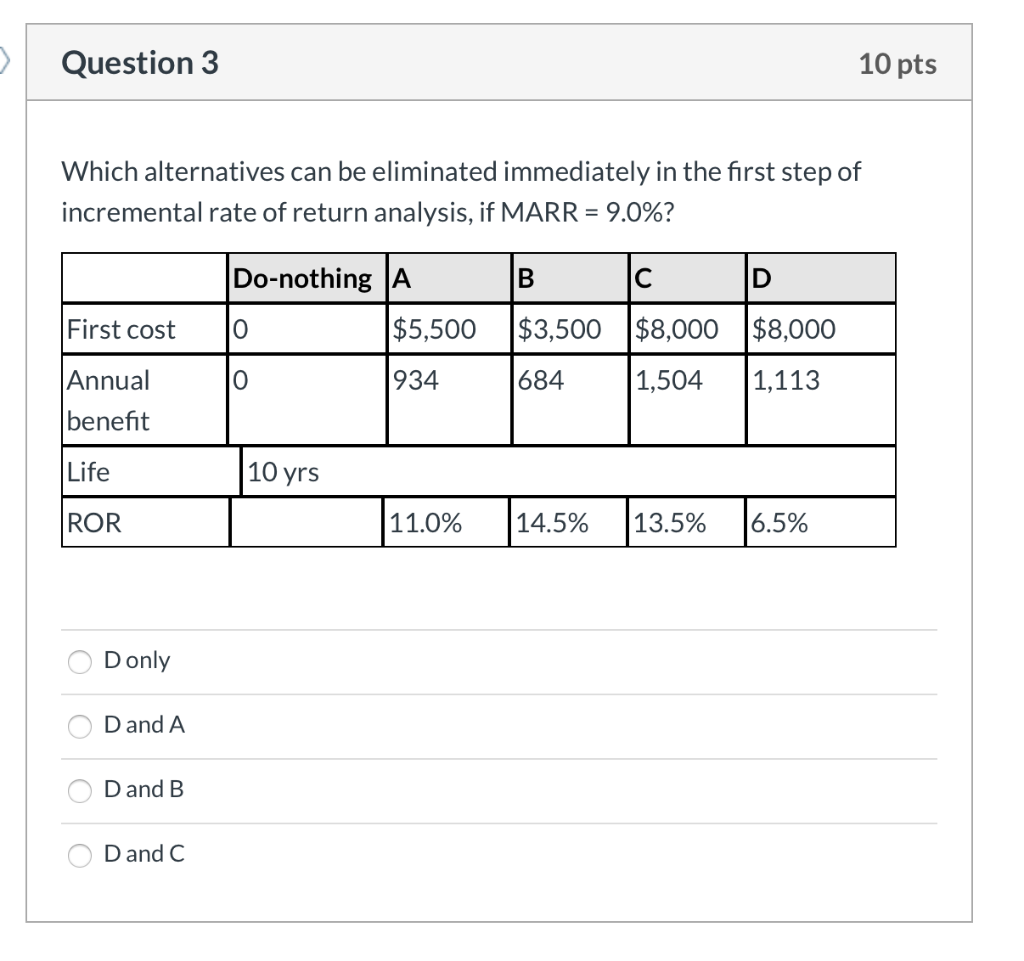

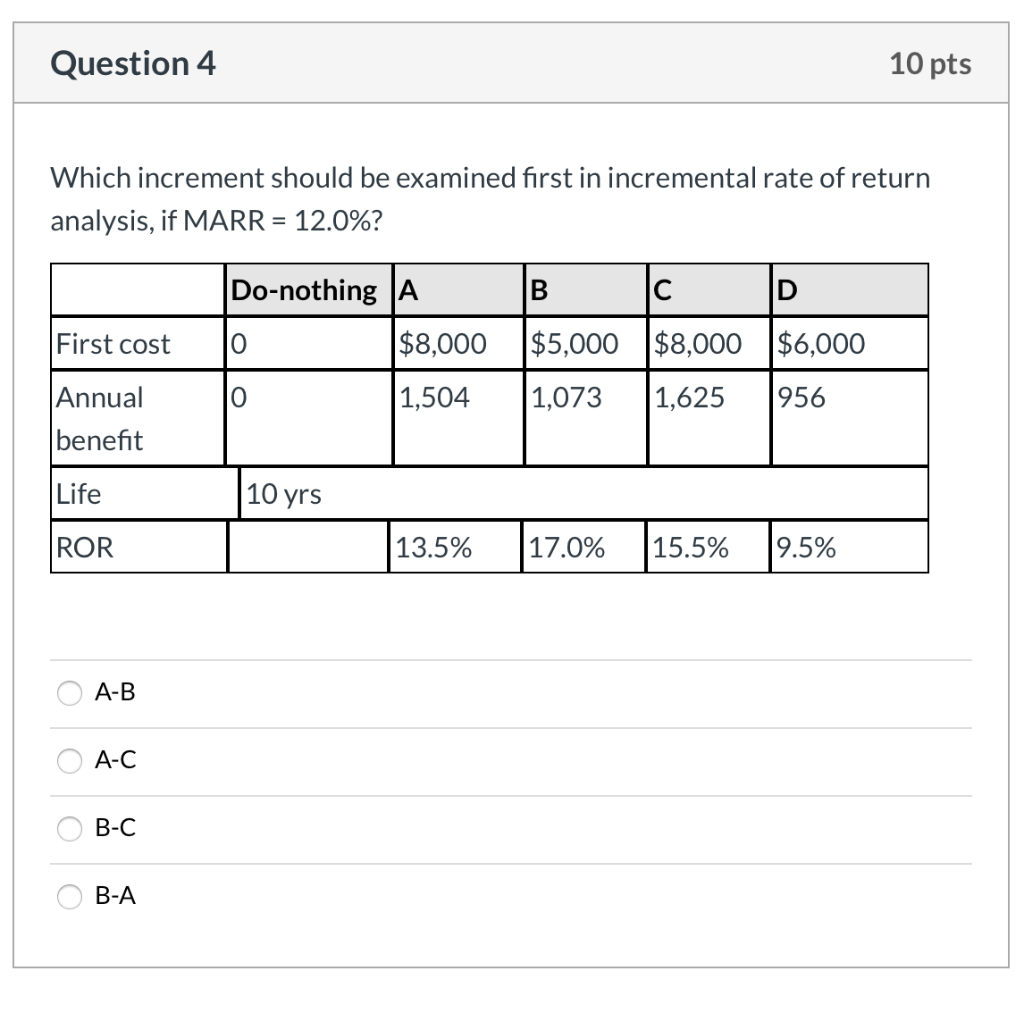

Question 5 10 pts Which alternative should be selected using incremental rate of return analysis, if MARR = 8.5%? Do-nothing A B C D First cost $6,000 $3,000 $9,500 $3,500 Annual 998 553 1,681 487 benefit Life 10 yrs ROR (10.5% 13.0% (12.0% 16.5% O B, because its ROR is the highest o something other than C, because C costs the most initially O C because C has the highest annual benefit o C, because the C-B increment has a ROR of 11.53% and the A-B increment has a ROR of 7.88% Question 3 10 pts Which alternatives can be eliminated immediately in the first step of incremental rate of return analysis, if MARR = 9.0%? Do-nothing A B C D First cost 10 $5,500 $3,500 $8,000 $8,000 Annual po 1934 benefit Life 10 yrs ROR 11.0% 14.5% 13.5% 6.5% 1684 1,504 1,113 O Donly O Dand A O Dand B O Dand C Question 4 10 pts Which increment should be examined first in incremental rate of return analysis, if MARR = 12.0%? |First cost Annual benefit Do-nothing A to $8,000 lo 1,504 B $5,000 1,073 C $8,000 1,625 D $6,000 956 Life 10 yrs ROR |13.5% 17.0% 15.5% 9.5% OA-B O A-C O B-C O B-A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts