Question: Question 5 10 pts You are considering installing an inventory management system for your warehouse. The total cash outlay required to install the system is

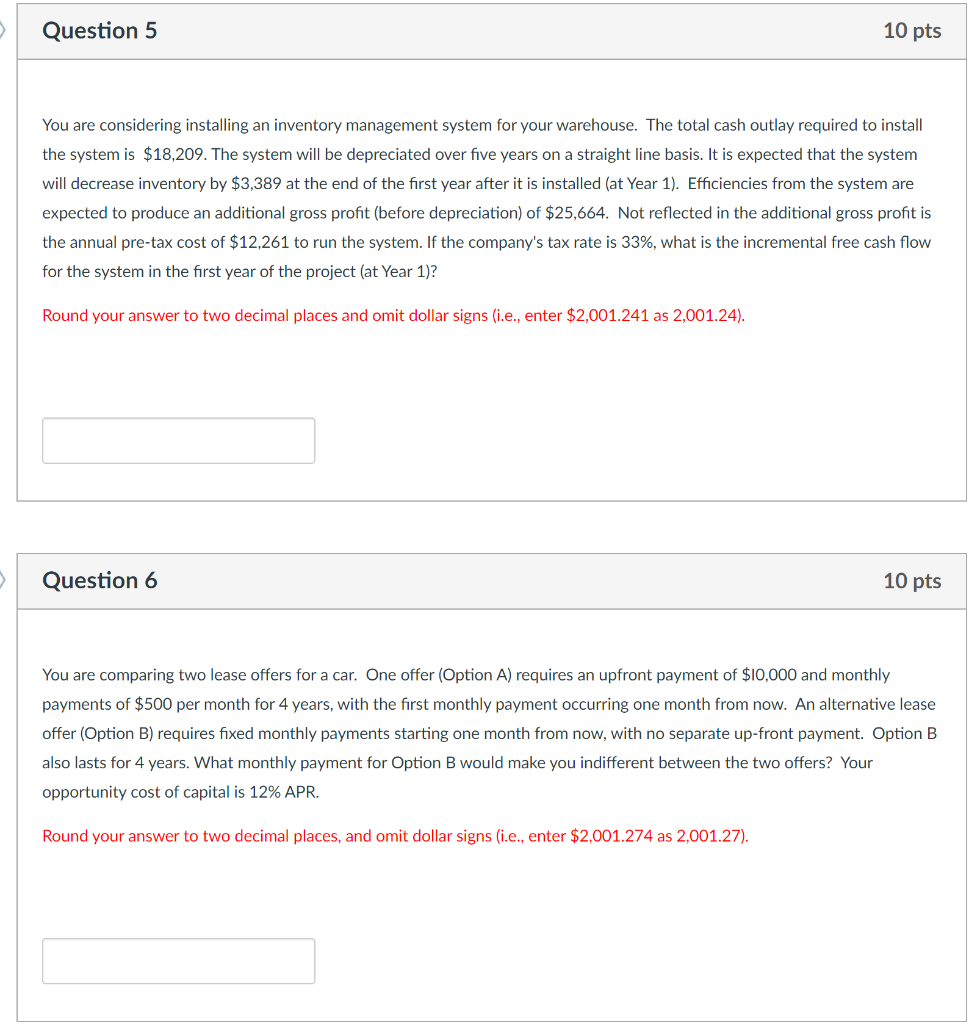

Question 5 10 pts You are considering installing an inventory management system for your warehouse. The total cash outlay required to install the system is $18,209. The system will be depreciated over five years on a straight line basis. It is expected that the system will decrease inventory by $3,389 at the end of the first year after it is installed (at Year 1). Efficiencies from the system are expected to produce an additional gross profit (before depreciation) of $25,664. Not reflected in the additional gross profit is the annual pre-tax cost of $12,261 to run the system. If the company's tax rate is 33%, what is the incremental free cash flow for the system in the first year of the project (at Year 1)? Round your answer to two decimal places and omit dollar signs (i.e., enter $2,001.241 as 2,001.24). Question 6 10 pts You are comparing two lease offers for a car. One offer (Option A) requires an upfront payment of $10,000 and monthly payments of $500 per month for 4 years, with the first monthly payment occurring one month from now. An alternative lease offer (Option B) requires fixed monthly payments starting one month from now, with no separate up-front payment. Option B also lasts for 4 years. What monthly payment for Option B would make you indifferent between the two offers? Your opportunity cost of capital is 12% APR. Round your answer to two decimal places, and omit dollar signs (i.e., enter $2,001.274 as 2,001.27)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts